Posted on 19 Jan 2024

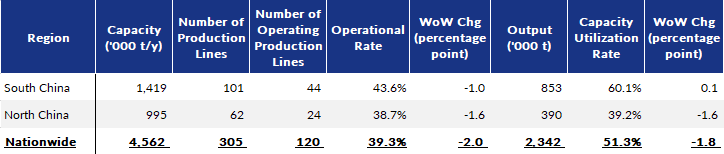

Rebar production among the 137 Chinese steelmakers nationwide monitored by Mysteel declined further over January 11-17 to hit an 11.5-month low of 2.34 million tonnes, the latest survey result shows. Over the survey week, rebar output fell for the fourth successive week at a faster pace of 3.4%, or down by 82,400 tonnes on week, as against the 0.7% dip in the prior week.

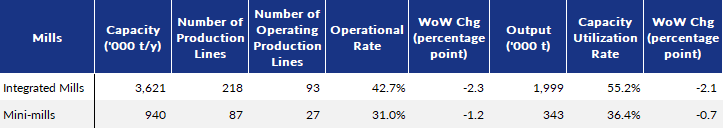

Survey respondents attributed the deeper decrease in rebar output during the survey period to the fact that domestic integrated mills conducted maintenance on more rolling lines and a few steel producers also switched production from rebar to other steel products over the same period.

Subsequently, both rebar rolling capacity utilization and operational rates among the surveyed 137 steelmakers slipped for the fourth week, with the former down 1.8 percentage points on week to 51.3% and the latter lower 2 percentage points to 39.3%, Mysteel's data showed.

The survey showed that steel mills in East China witnessed significant reductions in rebar output with their combined decrement topping 60,000 tonnes on week.

China's spot rebar price had been rangebound last week while its support from input costs subsided. As of January 18, the national price of HRB400E 20mm dia rebar, for example, lost by Yuan 15/tonne ($2.1/t) on week to touch a two-month low of Yuan 4,022/t including the 13% VAT, according to Mysteel's assessment.

Meanwhile, the Mysteel SEADEX 62% Australian Fines index for imported iron ore slid by $4.75/dmt on week to $130.15/dmt CFR Qingdao on January 18.

China's long steel demand weakened further lately, with the spot trading volume of rebar, wire rod and bar-in-coil among the 237 Chinese steel trading houses under Mysteel's tracking shedding 10.4% or 12,961 tonnes/day on week to average 111,761 t/d over January 12-18.

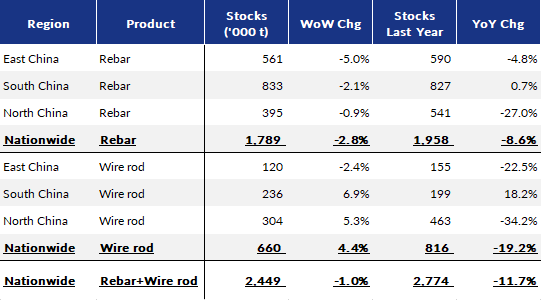

On the other hand, lower output saw rebar inventories at the 137 surveyed mills thin for the third week, down another 2.8% or 51,500 tonnes on week to 1.79 million tonnes as of January 17.

In tandem, the tonnage at the commercial warehouses in the 35 Chinese cities Mysteel follows continued the rise that began in mid-December last year to reach 4.7 million tonnes as of January 18, or up 4.9% or 217,700 tonnes on week.

Table 1: Rebar Production Survey by Region by Jan 17

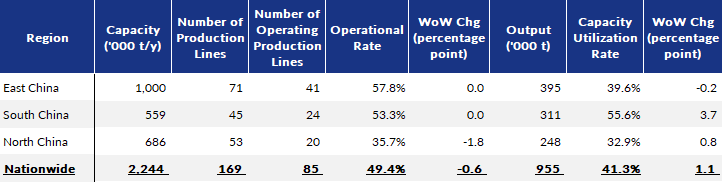

Table 2: Wire Rod Production Survey by Region by Jan 17

Table 3: Rebar Production Survey by Process by Jan 17

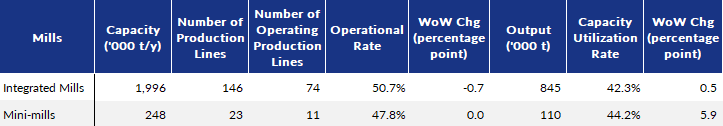

Table 4: Wire Rod Production Survey by Process by Jan 17

Table 5: Mills' Rebar and Wire Rod Stocks by Region by Jan 17

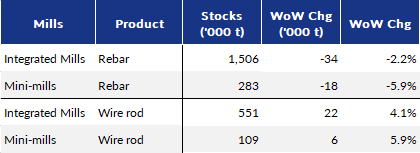

Table 6: Rebar and Wire Rod Stocks Survey by Process by Jan 17

Source:Mysteel Global