Posted on 29 Dec 2023

ASEAN-6 Macroeconomics Results

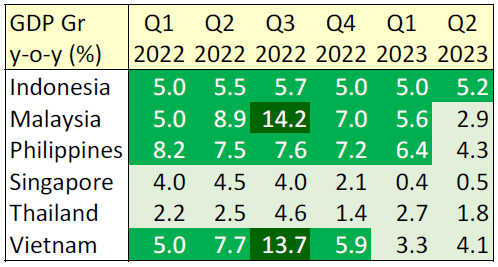

Given the challenges of high inflation and central bank efforts to rein in inflation, it is interesting to look at the effects on the economy in Q2 2023. My previous article on Q1 2023 showed all ASEAN-6 countries (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) economies posting growth in Q1 2023, though growth rates for Singapore and Vietnam were lower than the past years.

Now let us take a look at how the economies have trended since then.

ASEAN-6 Q2 2023 Macro Results

Q2 2023 is yet another quarter of growth for all ASEAN-6 countries. Slight expansions in economies in Indonesia, Singapore and Vietnam, while Malaysia, Philippines and Thailand saw slowdown in economic growth.

Indonesia’s economy accelerated to the highest rate in 3 quarters (+5.2% in Q2 2023 y-o-y), slightly higher than Q2 2023.

Growth in Q2 2023 was supported by growth in household & government consumption and investments, offsetting contraction in trade

Construction grew strongly at 5.2% in Q2 2023, compared to 0.3% in Q1 2023, as the government expedited construction of roads and irrigation systems ahead of the end of President Joko Widodo's final term in 2024.

Manufacturing grew +5.6% and steel related manufacturing industry also expanded. The base metals sector expanded +11.5% in Q2 2023, slower than the quarter before (+15.5%). The transportation equipment industry grew +9.7%, also slowing down from +17.3% in Q1 2023.

The mining sector expanded +5.0%, led by expansion in coal and lignite mining and oil & gas (+8.1%). Meanwhile, the metal ore mining sub sector was flat (+1.1%) in Q2 2023.

Malaysia’s economy moderated to +2.9% growth in Q2 2023, supported by growth in services (+4.7%), construction (+6.2%) and manufacturing (+3.2%). On the other hand, the mining and quarrying sector declined (-2.3%).

On the demand side, growth was attributed by private consumption (+4.3%), government spending (+3.8%) and investments (+5.5%) despite contractions in government spending (-2.2%), exports (-9.4%) and imports (-9.7%).

Private consumption which formed ~60% of GDP, was up by +4.3% in Q2 2023, during festive months, thought grow was slower than the quarter (+5.9%) before.

Government spending grew +3.8% reversing the contraction (-2.2%) the quarter before. Growth was in higher spending on supplies and services.

Gross fixed capital formation also rose +5.5% with structure expanding at +6.0%, followed by machinery & equipment (+4.4%). Other assets increased by 8.3% in Q2 2023. Private sector investments, which comprises 83.0% of total investments, expanded +5.1% while public sector investment grew +7.9%.

Exports shrank (-9.4%) due to weak external demand while imports also declined (-6.5%) due to weak internal demand.

Construction activities grew at +6.2% in Q2 2023 slower than the 7.4% in Q1 2023. Expansion was supported by growth in all sectors: civil engineering (+10.0%), specialised construction (+6.4%), residential construction (+6.1%) and non-residential building (+2.3%).

Manufacturing activities slowed down further to +0.1% from +3.2% in Q1 2023. Steel sector related manufacturing all expanded. Fabricated metals cluster grew +7.7%, followed by basic metals (+4.8%) and electrical equipment (+3.7) and motor vehicles and transport equipment. However, the computer and peripheral equipment cluster is down by -8.6%.

The mining sector contracted by -2.3% due to contraction in natural gas extraction (-3.6%) and crude oil and condensate (-1.5%).

The Philippine economy expanded 4.3% in Q2 2023, slightly slower that the +6.4% growth in Q3 2023. Growth was mainly driven by:

On the industry side, all economic sectors expanded, except mining and quarrying. The construction sector expanded by +3.5% in Q2 2023, slower than +11.1% in Q1 2023. Most of the value-add growth in construction came from businesses (+10.2% down from +20.9% last quarter) followed by government (+0.8% down from +5.1%). Households spending contracted (-3.9%, reversing from growth of +13.7%).

The manufacturing sector grew by +1.2% in Q2 2023, slowing down slightly from the quarter before (+1.9%). The transport equipment cluster expanded +12.9%, followed by electrical equipment (+9.8%), and basic metals (+3.7%). The machinery and equipment cluster contracted -17.0%, while the fabricated metal products cluster contracted -12.0%.

The mining sector contracted -24.7% extending the drop of -5.7% in Q1 2023, led by a huge contraction in the oil & gas cluster (-25.2%), followed by coal mining (-12.4%). Mining of nickel ores cluster expanded +24.1% followed by copper (+10.7%), gold & precious metals (+4.4%) and stone and quarrying & others (+3.4%).

The Singapore economy grew by +0.5% in Q2 2023, slightly faster (+0.4%) than in Q1 2023.

The construction sector grew by +6.8% in Q2 2023, extending the +6.9% growth in the previous quarter. Growth came on the back of expansions in both private and public sector construction works.

Certified progress payments grew by +12.5% in Q2 2023, following the +13.3% increase in the previous quarter. Higher certified progress payments came from:

Construction demand (contract awarded) fell by -11.6% in Q2 2023, deteriorating from the -1% contraction in the previous quarter:

The manufacturing sector shrank by 7.3% y-o-y in Q2 2023, worse than the 5.4% contraction in the previous quarter. This was mainly due to output declines across

all clusters except for the transport engineering cluster, which surged by 18.3%. Among the clusters that contracted, electronics (-12.1%) and precision engineering (-8.6%) saw the largest declines.

Output in the transport engineering cluster rose by +18.3% y-o-y in Q2 2023 on the back of expansions in the marine & offshore engineering (M&OE) and aerospace segments. The M&OE segment grew by +21.0%, due to a higher level of activity in the shipyards as well as increased production of oilfield & gasfield equipment.

Private consumption rose by +0.7%, slowing from the +6.6% in the preceding quarter, due to higher private consumption expenditure (+2.4%), which offset the decrease in public consumption expenditure (-4.7%).

Public spending fell -4.7% in Q2 2023, reversing the growth of +4.8% in Q1 2023.

Meanwhile, gross fixed capital formation (GFCF) decreased by 3.2%, worsening from the 0.5% decline in the previous quarter. The decrease was due to the decline in private sector GFCF (-4.6%), which outweighed the increase in public sector GFCF (+4.4%). Public sector GFCF rose due to higher investments in public construction & works, transport equipment, machinery & equipment and intellectual property products. Meanwhile, private sector GFCF fell on the back of lower investments in private construction & works, transport equipment, machinery & equipment, which more than offset the higher investments in private intellectual property products.

Total merchandise exports shrank -16.9% in Q2 2023, following the -6.5% in Q1 2023. This was due to decreases in both domestic exports (-19.5%) and re-exports (-14.5%). Domestic exports fell, due to decreases in both oil domestic exports (-28.1%) and non-oil domestic exports (NODX) (-13.4%). In volume terms, oil domestic exports grew by +8.9%.

Thailand’s GDP expanded by 1.8%, slower from a growth of 2.6% in Q1 2023, driven by high expansion of households expenditure, an increase in export of services and a deceleration of the inflation rate.

Private final consumption expenditure grew by +7.8%, in Q2 2023 after a +5.8% rise in Q1 2023 mainly due to the increase in numbers of domestic and foreign tourists, together with slowdown in inflation. In this quarter, spending on durable goods is up by 3.2%, followed by non-durable goods (+4.2%) and net services (+13.8%). In contrast, spending on semi-durable goods increased by +0.7%, lower than a rise of +1.3% in Q1 2023.

Government spending dropped by -4.3% in Q2 2023, from a -6.3% fall a quarter ago, due to social transfers in kind - purchased market production which contracted by (-25.1%) caused partly by high level of healthcare spending in 2022. Purchases of goods and services and shrank by -2.6%, while compensation of employees expanded by +0.3%.

Gross fixed capital formation rose by +0.4% in Q2 2023, compared to a +3.1% rise in Q1 2022. Private investment expanded by +1.0%, decelerated from -2.6% in Q1 2023, both from construction (+2.0%) and machinery (+0.8%) investment. On the other hand, public investment contracted by -1.1%, reversing a rise of +4.7% in Q1 2023. This is due to a +0.5% increase in the general government and a -3.7% fall in state enterprises.

As for external sector, exports of goods and services decelerated (+0.7%), whereas imports of goods and services consecutively fell (-2.4%).

On the production side, agriculture and non-agriculture sectors decelerated. The service sector expanded especially for tourism-related activities, while the industrial sector consistently declined.

Construction increased by +0.4% in Q2 2023, slower than the rise of +3.9% the quarter before, due to a decline in public construction (-0.6%) works as most projects were ongoing and there was no new projects in this quarter.

Private construction grew +2.0%, led by other construction (+3.0%), dwellings (+1.7%) and non-dwelling (0.1%) construction.

Manufacturing production decreased by -3.3% in Q2 2023, continuing a fall of -3.0% in Q1 2023. The decline was apparent in all types of industries:

Mining and quarrying fell by -1.2% after a -5.2% drop in Q1 2023, due to contractions in major activities. Crude oil production declined by 7.6%, continuing a fall of –7.3% in Q1 2023. Furthermore, natural gas production decreased by -2.5%, following a drop of -9.0% in Q1 2023. Meanwhile, condensate production grew by +3.3%, in contrast to a decline of -2.5% in Q1 2023, owing to higher outputs from significant fields. Besides, quarrying of stone, sand, and clay increased in line with the increasing demand from the domestic construction industry.

The Vietnam economy has been expanding since Q4 2021 hitting a peak of +13.7% in Q3 2022. Vietnam’s GDP rose by +4.14% in Q2 2023, faster than +3.3% in Q1 2023.

Construction activities rose by +7.05% in Q2 2023, faster than 1.88% in Q1 2023. The construction sector grew 7 quarters in a row, after a contraction of 10.1% in Q3 2021 when lockdowns of major economic zones hit the economy.

The manufacturing sector expanded slightly at +1.18% in Q2 2023 reversing the decline of -0.37% in Q1 2023.

Manufacturing activities related to the steel and steel consuming sectors performance is shown below (vs Q1 2023):

The mining sector expanded +1.9% in Q2 2023 reversing a decline of -1.7% Q1 2023, led mainly by contraction in the mining support service activities (-36.3%). Clusters that expanded were metal ores (+7.9%), extraction of crude petroleum and natural gas (+7.7%), stone & quarrying (+1.6%), coal and lignite (+1.0%), , mining of coal and lignite (-0.6%). Mining of metal ores subsector expanded +14%, slowing down from a +44% growth last quarter.

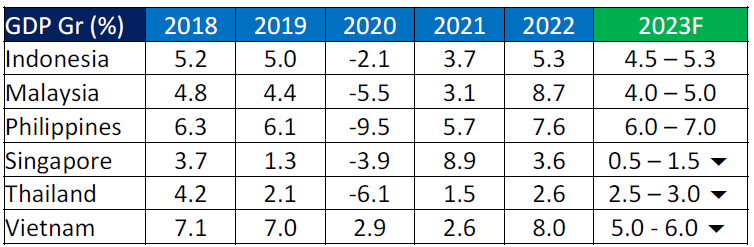

ASEAN GDP 2018-2022 and Forecast for 2023

With solid economic growth, Indonesia expects the economy to grow at the upper bound of 4.5-5.3% range on the back of improving domestic demand and persistently strong export performance. However, activities are expected to slow down in the later half

with exports likely drop due to weaker global demand and businesses potentially delaying investments ahead of general elections due in February 2024.

The Malaysian Government remains confident to meet its GDP forecast of 4.0% – 5.0% for 2023 as the domestic economy remains vibrant with many indicators showing healthy trends. The Government will maintain its responsive fiscal policy and will continue to focus on expediting the realisation of approved investments and accelerate implementation of Government projects. However, external demand for the H2 2023 will continue to be affected by global geopolitical tensions, continuing supply chain disruption, tight monetary policy and the growth prospects of major trading partners.

The Philippine economy is expected to sustain its expansion driven by services as employment conditions and tourism-related spending improve. The government will implement catch-up plans and expedites programs and projects for the rest of the year to achieve the growth target of 6.0% to 7.0% or 2023.

Singapore expects to be affected by protracted downturn in global electronics demand, persistent inflation affected external demand, escalations in the Ukraine war and geopolitical tensions; all are expected to weigh on global trade. The outlook for the manufacturing and finance sectors are likely to be subdued while the growth outlook for aviation- and tourism-related sectors remains positive. Consumer-facing sectors are expected expand with market recovery. With these, the government has narrowed the GDP growth forecast for 2023 to “0.5 to 1.5%”, from “0.5 to 2.5%”.

The Thai economy in 2023 is projected to expand in the range of 2.5 – 3.0% due to favourable growth of private consumption, the continual recovery of tourism sector and the continual expansion in both private and public investments. Consumption and expenditure are expected to increase by 5.0% and 1.6%, respectively. Headline inflation is estimated to be in the range of 1.7 – 2.2% and the current account is projected to record a surplus of 1.2% of GDP.

Vietnam's GDP growth is expected to reach 5.0 - 6% in 2023 despite efforts to resolve business and production difficulties. Ministry analysts have said that economic growth in the final quarter would depend on how quickly industrial production recovers, especially in manufacturing and processing. Another factor is demand from Vietnam’s major export markets, as well as tourism and spending within the country at the end of the year and for the upcoming Lunar New Year holiday.

Stay Healthy. Stay Safe.

See You at SEAISI Events.

Source:SEAISI