Posted on 07 Dec 2023

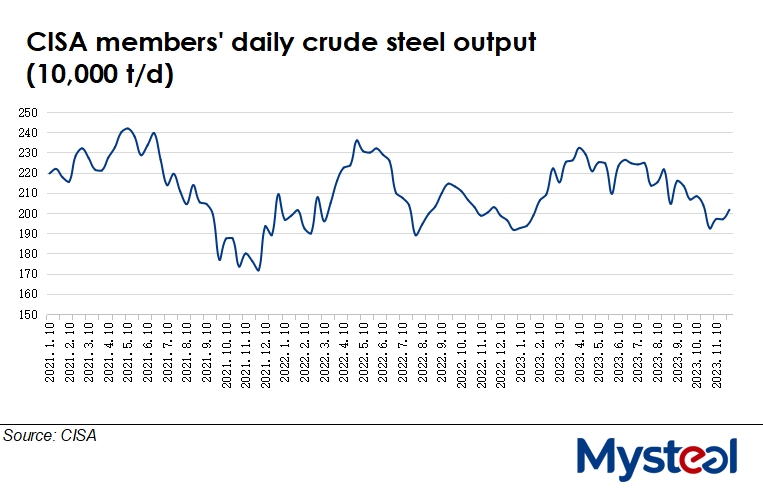

Daily crude steel production among the member mills of the China Iron and Steel Association (CISA) during the last ten days of November climbed to a one-month high of 2.02 million tonnes/day, according to the association's latest release late Tuesday. The daily output in late November was higher by 2.4% or 47,000 t/d from November 11-20, it notes.

Behind the rise in output was the fact that many domestic steel mills ramped up production during the period after their profit margins on steel sales had improved, according to a market source.

Nonetheless, late November's daily crude steel output still posted an on-year dip, with the volume nudging down by 0.6% from the same period in 2022, according to the release.

Based on its member-mill results, CISA also estimated that the country's daily crude steel output averaged 2.58 million t/d over November 21-30, rising by 1.7% from mid-November.

Domestic steel prices across China had fluctuated during late November with market sentiment cooling down. As of November 30, the country's national price of HRB400E 20mm dia rebar, for example, lost Yuan 4/tonne ($0.6/t) from that on November 20 to Yuan 4,052/t including the 13% VAT, according to Mysteel's assessment.

Despite higher output, finished steel stocks held among CISA member mills decreased by 15.4% or 2.37 million tonnes from November 20 to reach 12.96 million tonnes by the end of November, according to the association. This result was also lower by 15.3% or 2.34 million tonnes from the corresponding period last year, the data show.

As of November 30, total inventories of the five major finished steel products - rebar, wire rod, hot-rolled coil (HRC), cold-rolled coil and medium plate - at both the 184 domestic steelmakers and in traders' warehouses in 35 Chinese cities under Mysteel's tracking came in at 13.1 million tonnes, lower by 0.1% or 10,900 tonnes on week, Mysteel's data showed.

Within the five items, HRC stocks declined the most, with the tonnage held by surveyed producers and traders thinning by 46,300 tonnes or 1.3% on week to 3.4 million tonnes, indicating resilient consumption from downstream users.

Source:Mysteel Global