Posted on 23 Nov 2023

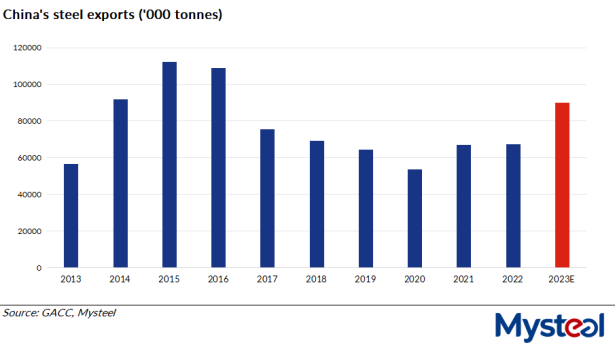

China's steel exports are expected to remain at a relatively high level next year as scope still exists for global steel demand to grow in 2024, Mysteel's latest report predicts. But whether the country's steel exports also rise next year it's too soon to tell.

This year, oversupply of finished steel in the domestic steel market and weak demand have seen China's steel products gain ground in the international steel market, Mysteel's report noted. Chinese steel has enjoyed price advantages when targeting global business where steel supply is falling and demand rising.

Overall, global steel supply has been trending downward in the past two years, as steel producers are impacted by surging production costs brought about by geopolitical conflicts and other impacts from natural disasters, Mysteel notes.

For example, seven out of the top 10 steelmaking countries worldwide posted on-year declines in their crude steel production over January-September this year, according to the latest data released by the World Steel Association (WSA).

On the other hand, global steel demand is forecast to grow by 1.8% to reach 1.81 billion tonnes in 2023 and will see a further rise of 1.9% in 2024, the WSA's latest short-range outlook predicted.

Crude steel output of the world's top 10 steelmaking countries | ||||

Country | Sept 2023 | Jan-Sept 2023 | ||

(mln t) | Y-o-Y (%) | (mln t) | Y-o-Y (%) | |

Total 63 | 149.3 | -1.5 | 1,406.4 | 0.1 |

China | 82.1 | -5.6 | 795.1 | 1.7 |

India | 11.6 | 18.2 | 104.1 | 11.6 |

Japan | 7.0 | -1.7 | 65.4 | -3.6 |

U.S. | 6.7 | 2.6 | 60.6 | -1.4 |

Russia (e) | 6.2 | 9.8 | 57.1 | 4.8 |

South Korea | 5.5 | 18.2 | 50.4 | -0.4 |

Germany | 2.9 | 2.1 | 27.2 | -3.6 |

Türkiye | 2.9 | 8.4 | 24.5 | -10.1 |

Brazil (e) | 2.6 | -5.6 | 24.0 | -8.0 |

Iran | 2.4 | -12.7 | 22.1 | -0.6 |

(e): estimated, source: WSA

Domestically, the contradiction between high crude steel output and low steel consumption has been weighing on China's steel market, with many steel producers choosing to seize overseas trading opportunities as a channel for finding buyers for their inventory.

During this year's first 10 months, China's crude steel output totalled 874.7 million tonnes, higher by 1.4% on year, according to the latest release by the country's National Bureau of Statistics (NBS).

However, the largest consumer of the country's steel, China's property market, has been struggling. Over January-October, total funding in China's property market declined by 9.3% on year to sit at Yuan 9.59 trillion ($1.34 trillion), while the total area of the country's newly-launched property projects also dropped by 23.2% on year to 791.8 million sq m during the same period, the NBS data showed.

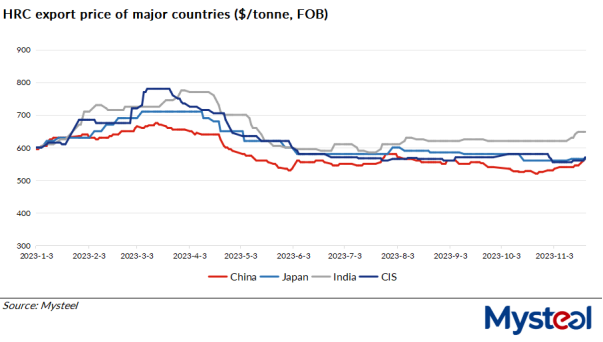

In parallel, Chinese steel products generally enjoyed price advantages in international steel markets, supporting both the activity and volume of China's steel exports. As of October 31, the export price of Chinese SS400 4.75mm hot-rolled coil (HRC) was assessed by Mysteel at $530/t FOB from North China's Tianjin port, lower by $30/t compared with Japan-origin offers posted the same day, according to Mysteel's survey.

Under these circumstances, China's steel exports are likely to total 90 million tonnes in 2023 after reaching 74.73 million tonnes in the first ten months, and may continue to stay at a relatively high level in 2024, Mysteel's report predicted. During this month and next, China will likely export about 7.5 million tonnes per month, Mysteel Global notes.

Looking ahead, however, 2024 may not see any further rise in China's steel exports, according to Mysteel's report, as steelmakers' meagre profits from export trading will make shipping abroad unattractive. Moreover, China's central government is keen to steel output decline in the long run.

In fact, falling export prices of steel products and rising import prices of raw materials have gradually whittled down the profits earned by Chinese steel exporters, the report pointed out.

In September this year, the average export price of Chinese SS400 HRC was assessed by Mysteel at $597/t FOB, dropping by 30% from September 2022. Meanwhile, the average price of Mysteel PORTDEX 62% Australian Fines in Qingdao rose by 24% on year as of the same month to reach Yuan 940/wmt FOT and including the 13% VAT.

Regarding oversupply in China's steel market, the industry is striving for reduce overcapacity and control steel output, the report commented, arguing that the mismatch between supply-demand in China's domestic steel market may narrow in the future. This in turn should see Chinese steelmakers benefit more from home-market business.

Source:Mysteel Global