Posted on 03 Nov 2023

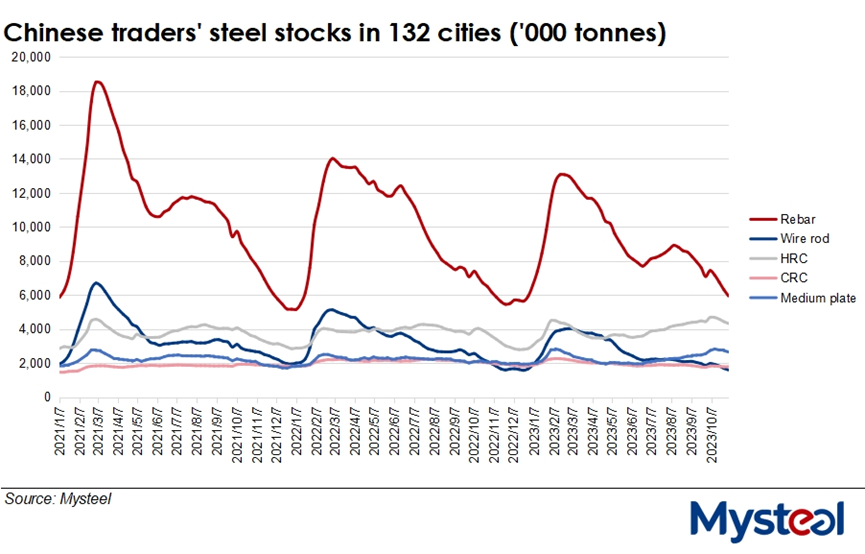

The thinning of the five major finished steel stocks held by Chinese traders continued over October 27-November 2, with the volume declining by another 3.7% on week amid the stable trading during the week, according to the findings of Mysteel's latest weekly survey. Helping too has been greatly improved market sentiment.

The inventories of rebar, wire rod, hot-rolled coil (HRC), cold-rolled coil and medium plate at traders' warehouses in the 132 cities Mysteel tracks nationwide declined for a fourth straight week, down by 632,700 tonnes on week at 16.3 million tonnes as of November 2, the data indicated.

"The favorable government policies have continuously stimulated steel-market sentiment, leading to the steady increases in domestic steel prices in both the physical and futures markets," said a market source, adding that "demand from end-users was relatively stable too, so spot sales overall were good."

China's national price of HRB400E 20mm dia rebar, for example, had jumped by Yuan 55/tonne ($7.5/t) on week to nearly a 1.5-month high of Yuan 3,891/t including the 13% VAT as of November 1, Mysteel's assessment showed.

In addition, the trading volume of rebar, wire rod and bar-in-coil among the 237 trading houses across China which Mysteel canvasses averaged 167,951 tonnes/day over October 26-November 1, rising by 9.3% or 14,308 t/d on week.

The traders' stocks of rebar and HRC decreased by 365,300 tonnes and 109,300 tonnes on week to 5.95 million tonnes and 4.33 million tonnes respectively as of Thursday, according to the survey.

Some industry insiders were optimistic about near-term steel prices, telling Mysteel Global that some traders were showing an inclination to stock up quantities in a bid to sell at a high price later.

On the other hand, steel inventories held by traders in Mysteel's former smaller sample across just 35 cities also fell for a fourth week last week, declining by 3.7% or 378,800 tonnes on week to 9.9 million tonnes by November 2.

Source:Mysteel Global