Posted on 31 Oct 2023

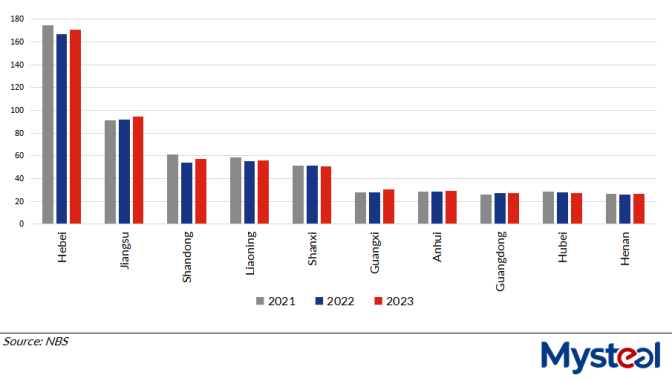

Eight out of the top 10 steelmaking provinces and autonomous regions across China posted on-year rises in their crude steel production over January-September, according to the latest data released by the country's National Bureau of Statistics (NBS).

Behind the on-year gains was the relatively low base for 2022 when China's steel market was struggling with the pandemic, global high inflation, and geopolitical conflicts, Mysteel Global noted.

Table 1 Jan-Sept steel output among China's top 10 steel-producing hubs (million tonnes)

However, during September all the top five steelmaking provinces posted on-year declines in their steel output, reflecting the thinner profit margins and even losses being borne by steelmakers in those regions, plus the weaker-than-expected demand for steel from end-users last month, even though steel sales in China usually perform strongly in September, according to market sources.

For example, as of September 29, the profit ratio among the 247 blast furnace (BF) mills nationwide under Mysteel's tracking registered just 34.2%, dropping by 17.32% from late September last year, according to Mysteel's survey.

Last month, the daily trading volume of construction steel comprising rebar, wire rod and bar-in-coil among the 237 Chinese trading houses that Mysteel follows averaged just 148,531 tonnes/day, down by 17.5% on year, and lower than the usual average of 200,000 t/d for the traditional peak consumption season over September-October.

Source:Mysteel Global