Posted on 25 Oct 2023

Prices of Chinese hot-rolled coil (HRC) for export remained generally unchanged during the week of October 16-20, while deals involving hot coils for export remained scant during the same period, market sources noted.

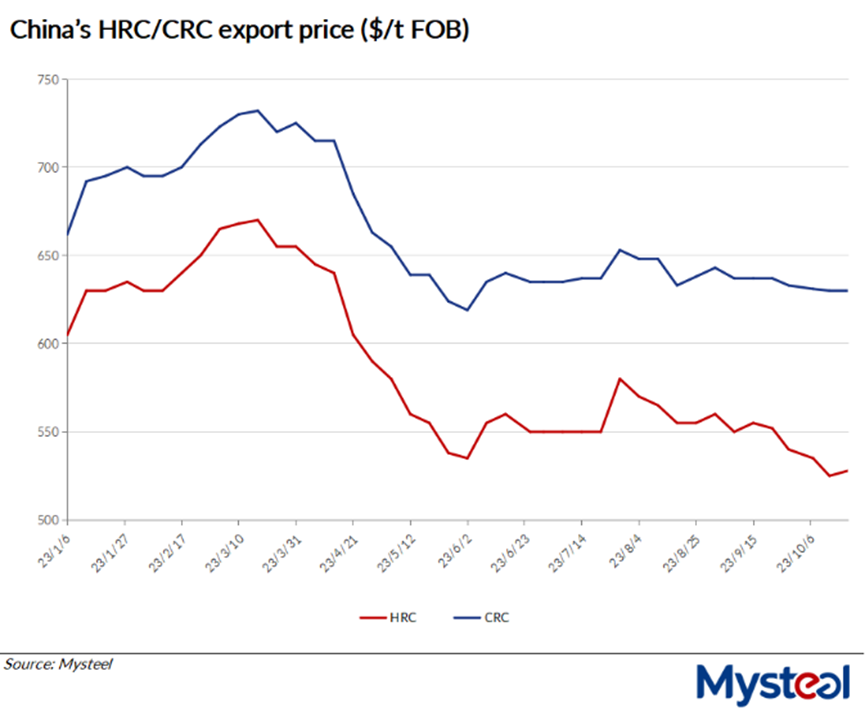

As of October 20, the export price of Chinese SS400 4.75mm HRC under Mysteel's assessment was at $528/tonne FOB from North China's Tianjin port, up by just $3/t on week. As of the same day, the export price of China-origin SPCC 1.0mm cold-rolled coil was unchanged at $630/t, also on FOB Tianjin basis.

Against the backdrop of subdued demand for hot coils worldwide, major steel mills in Asia and Southeast Asia either maintained their sales prices for the flats or pared them back.

For instance, Tokyo Steel Manufacturing, Japan's leading electric arc furnace steelmaker, announced last week that it was holding its HRC (1.7-22mm) prices for domestic sales in November at $710/t, dollar equivalent.

In Vietnam, local steel giant Formosa Ha Tinh, last week cut its SAE1006 HRC prices by $15/t (dollar equivalent) on month to $575-580/t CIF Ho Chi Minh City, for late October and early November delivery.

For the same reason of dull global demand for HRC, leading Chinese steelmakers also lowered their offering prices for export hot coils by $5-10/t on week to attract deals, according to market sources.

During last week, some deals involving China-origin SS400 HRC were concluded in Southeast Asia, with the prices decided at $525-530/t CFR. No agreements were reached in South Korea for the same flat product however, with quotations there being $535-540/t CFR, sources noted.

Meanwhile, business for China-origin hot coils also cooled in the Middle East and North Africa, as local demand continued to slip.

Export sales of Chinese hot coils for November and December shipment may be weaker than those for October, market sources predicted.

Source:Mysteel Global