Posted on 20 Oct 2023

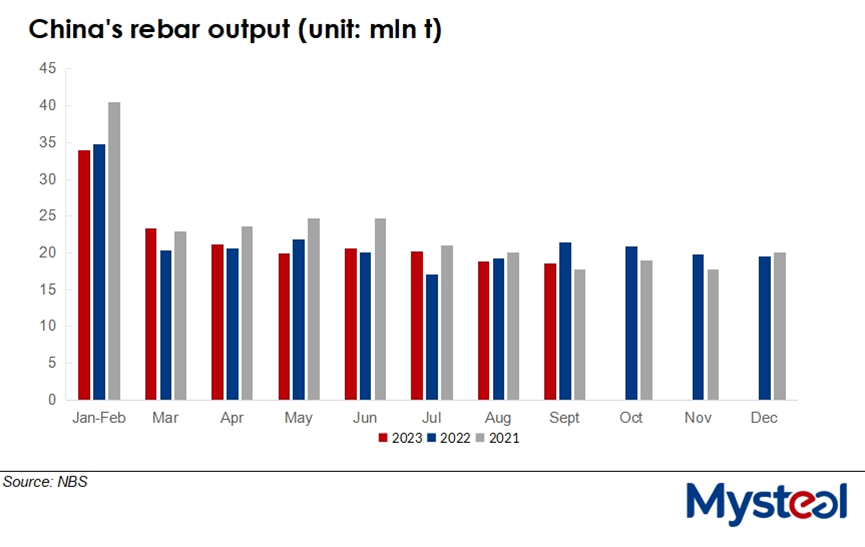

Production of rebars across China over January-September rose by a tiny 0.3% on year to 174.6 million tonnes, according to the latest data released by the country's National Bureau of Statistics (NBS) on Thursday. In contrast, output in September fell by a fairly substantial 11.4% on year to reach 18.6 million tonnes.

Rebar output last month also slipped by 0.8% from August, marking the third successive monthly decline, Mysteel Global calculated based on the NBS data. The on-month slide reflected the fact that more Chinese steelmakers cut production to mitigate the margin losses they were suffering, sources observed, citing their high production costs.

Meanwhile, rebar accounted for 17% of the country's finished steel output for this year's first nine months and 15.8% of that for September, the NBS data showed, totalling 1.03 billion tonnes and 117.8 million tonnes respectively.

During September, China's domestic steel prices had strengthened, but the rise in raw materials prices such as iron ore had outpaced that of steel prices, Mysteel Global notes.

For example, the country's national price of HRB400E 20mm dia rebar was assessed by Mysteel at an average of Yuan 3,839/tonne ($525/t) last month, higher by Yuan 56/t from the August average, while the Mysteel SEADEX 62% Australian Fines iron ore index had soared by $11.4/dmt to average $120.4/dmt CFR Qingdao over the same period.

Mysteel's survey of 91 blast-furnace mills it tracks nationwide showed that their losses on rebar sales averaged Yuan 152/t in September, deepening by Yuan 97/t on month, as reported.

Meanwhile, steel demand showed a modest improvement last month, though the pace of recovery was weaker than market participants had expected. The daily trading volume of construction steel comprising rebar, wire rod and bar-in-coil among the 237 trading houses under Mysteel's regular tracking averaged 148,530 t/d in September, rising by 2.6% on month, but still far below the threshold of 200,000 t/d usual for September-October, traditionally peak consumption months.

Source:Mysteel Global