Posted on 18 Oct 2023

Prices of Chinese hot-rolled coil (HRC) for export edged down during October 7-13, the first week after the country's Mid-Autumn Festival and National Day holidays over September 29-October 6, mainly in response to falling domestic prices of hot coils, market sources noted.

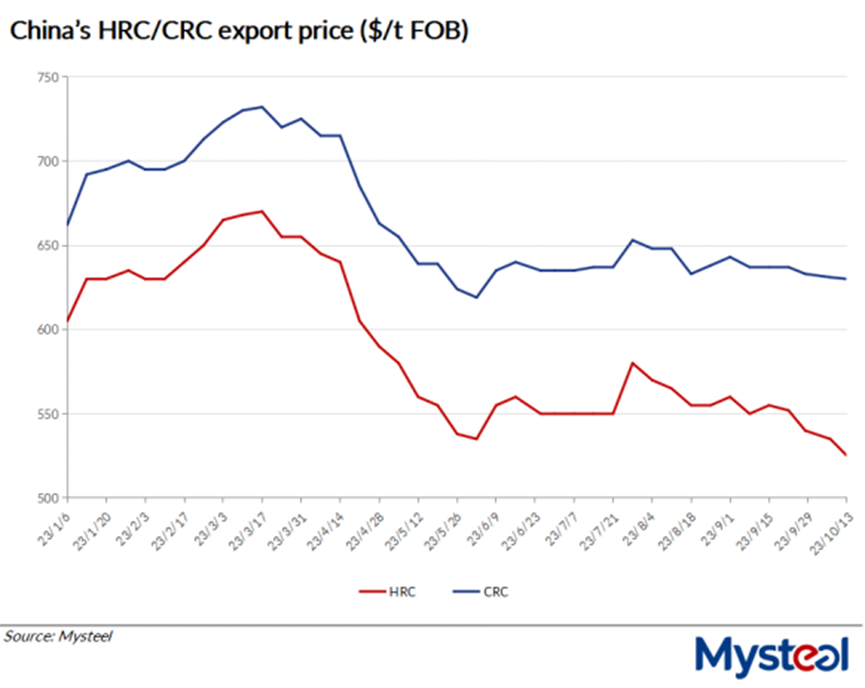

As of October 13, the export price of Chinese SS400 4.75mm HRC under Mysteel's assessment was $525/t FOB from North China's Tianjin port, down by $10/tonne from October 7, a substitute working day after China's long holiday.

Also as of last Friday, the export price of China-origin SPCC 1.0mm cold-rolled coil had inched down by $1/t during the same period to sit at $630/t, also on FOB Tianjin basis.

China's underperforming domestic HRC market led most Chinese steel producers including leading makers to set their offering prices for SS400 HRC for export at $540/t FOB – a relatively low level compared with their quotations before the holidays – hoping to attract export business.

A few steelmakers tabled export offers for the same product lower at $520-530/t FOB, according to market sources.

As such, export transactions for Chinese hot coils gained some upward momentum during the survey period, with orders being reached with customers in Southeast Asia, South America and the Middle East.

With domestic steel prices lacking any strong impetus to rise recently, many Chinese steel mills were keen to seek export business, sources commented.

On the other hand, however, the international HRC market has also been suffering from weak demand, they added.

For example, in Vietnam, most buyers were pessimistic about the market and are generally holding a wait-and-see stance regarding purchases.

Hot coil users there are preferring lower-priced China-origin hot coils, though last week bid prices for large-lot purchases of Chinese SS400 HRC were as low as 520/t CFR for November shipment, the sources noted.

Source:Mysteel Global