Posted on 27 Sep 2023

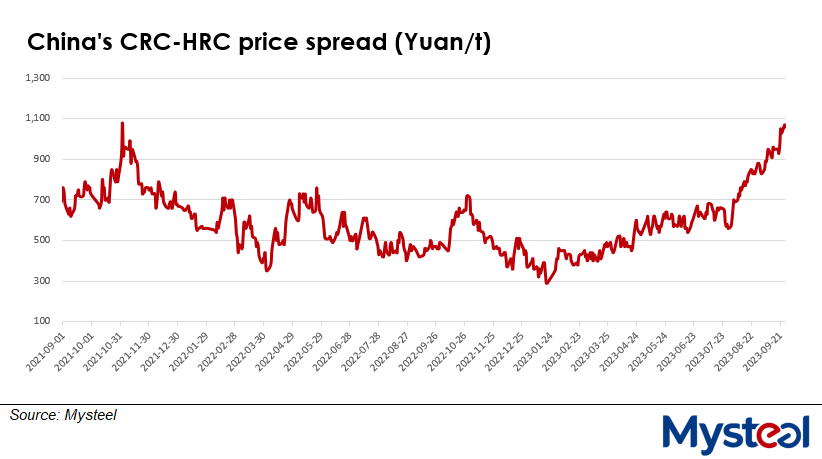

The price spread between carbon steel cold-rolled coil (CRC) and hot-rolled coil (HRC) in China has continued to widen since August, with the price differential between SPCC 1.0mm CRC and Q235 4.75mm HRC in Shanghai hitting a 22-month high of Yuan 1,070/tonne ($146.4/t) as of September 25, Mysteel's latest tracking showed.

The current price gap is unusually wide as the range between Chinese CRC and HRC is normally Yuan 500/t, Mysteel Global understands, and chiefly responsible seems to be the deepening divergence of the two products' own market fundamentals.

The current price gap is unusually wide as the range between Chinese CRC and HRC is normally Yuan 500/t, Mysteel Global understands, and chiefly responsible seems to be the deepening divergence of the two products' own market fundamentals.

On the supply side, China's HRC production has been rising since early August and is now hovering at a relatively high level, Mysteel's regular survey among 37 Chinese flat steelmakers showed. Over the weeks of August 4-September 22, their weekly HRC output had reached 3.14 million tonnes on average, as against 3.02 million tonnes during the corresponding period last year.

Meanwhile, Mysteel's tracking of 29 steel producers nationwide showed that their CRC output has remained largely stable over the past two months. Since August, weekly production of cold coils among the sampled mills had averaged 817,000 tonnes as of September 22, as against an average of 778,000 tonnes/week during the same period in 2022.

On the demand side, consumption of CRC throughout China has performed better than that of HRC, Mysteel's weekly survey showed. Apparent consumption of the five major steel products nationwide (comprising rebar, wire rod, HRC, CRC and medium plate) showed an uptrend in CRC use recently, with the steel item's consumption over the four survey weeks ending September 22 up from 807,400 tonnes to 871,400 tonnes.

However, China's demand for HRC exhibited an opposite trend, with Mysteel's same survey on five key carbon steel products showing that HRC consumption nationwide has been declining steadily this month. During the week ending September 22, the country's total consumption of hot coils had slipped to 3.07 million tonnes from 3.21 million tonnes recorded in the first week of the month.

China's relatively firm demand for cold coils is largely thanks to the country's robust production of automobiles, Mysteel Global noted. During January-August this year, Chinese auto output had climbed by 7.4% on year to reach 18.23 million units, based on China Association of Automobile Manufacturers statistics, as Mysteel Global reported.

Another key factor yawning the CRC-HRC price spread wider has been the accumulation of HRC inventory. Mysteel's weekly tracking of 184 steel mills and warehouses in 35 Chinese cities showed that their total stocks of hot coils had swollen from 3.75 million tonnes at the start of this month to top 3.85 million tonnes by the survey week ending on September 22.

In contrast, China's total CRC stocks assessed by Mysteel in the same survey had thinned from 1.53 million tonnes during this month's first week to 1.44 million tonnes during the week to last Friday. The destocking of CRC stocks is expected to continue in the near term, which will further bolster CRC fundamentals.

The unusually wide price spread between Chinese CRC and HRC may persist a while longer until the high supply pressure of hot coils eases and a new supply-demand balance is reached in Q4, Mysteel Global notes. This is when annual autumn/winter production restrictions are imposed on steel mills in many regions across the country as local governments attempt to keep atmospheric pollution at bay.

Source:Mysteel Global