Posted on 26 Sep 2023

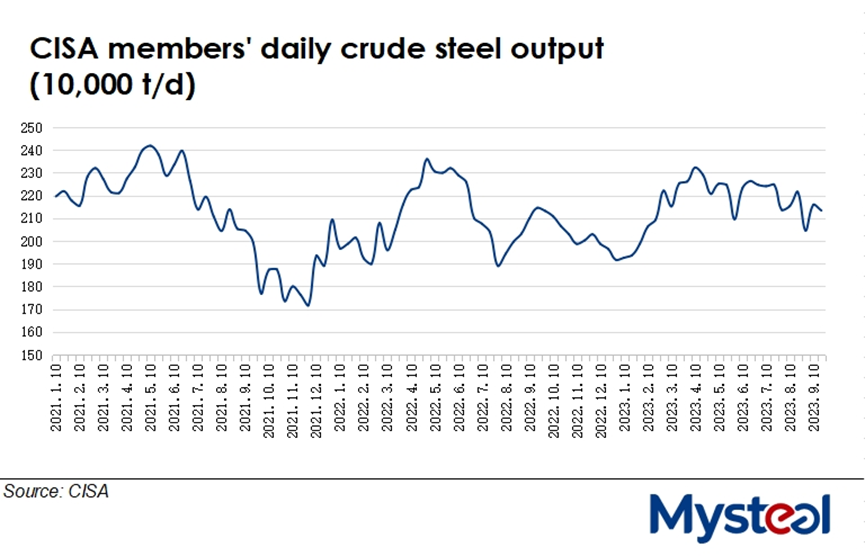

Daily crude steel output among the member mills of the China Iron and Steel Association (CISA) over September 11-20 declined from the first ten days of this month, slipping by 1.2% or 25,300 tonnes/day to reach 2.13 million t/d on average, according to the association's release late on Friday. Average daily output during mid-September was also lower by 0.5% on year, it noted.

Market sources attributed the fall in output to the fact that steel mills' enthusiasm for production had been dampened by their poor steel margins due to rising production costs. At the same time, demand from end-users has been recovering at a slower-than-expected pace when September is usually a month when steel demand picks up for autumn.

Based on its member-mill results, CISA also estimated the country's daily crude steel output averaged 2.78 million t/d over mid-September, slipping by 1.1% from September 1-10.

Mysteel's survey among a larger group of the 334 Chinese steel mills comprising 247 BF and 87 electric-arc-furnace makers was in line with CISA's result, as their daily crude steel output in mid-September had also decreased by 0.2% or 7,200 t/d from early September to average 3.03 million t/d.

Chinese finished steel prices strengthened moderately during mid-September, but steelmaking raw materials prices remained high. The country's national price of HRB400E 20mm dia rebar under Mysteel's assessment averaged Yuan 3,847/tonne ($526/t) during September 11-20, higher by Yuan 24/t from early September's average.

In tandem, for iron prices, Mysteel SEADEX 62% Australian Fines, for example, moved up by a larger $5.5/dmt during the same period to an average of $123.2/dmt CFR Qingdao.

In mid-September, the daily trading volume of rebar, wire rod and bar-in-coil among the 237 Chinese trading houses under Mysteel's tracking had risen by 8% from the average for early September to 152,053 t/d, though far below average daily trades of 200,000 t/d usual for robust demand seasons.

On the other hand, finished steel stocks at the association's member mills inched down 0.3% from September 10 to 15.8 million tonnes by September 20, which was also lower by 10.8% from the same period last year, according to the release.

Source:Mysteel Global