Posted on 22 Sep 2023

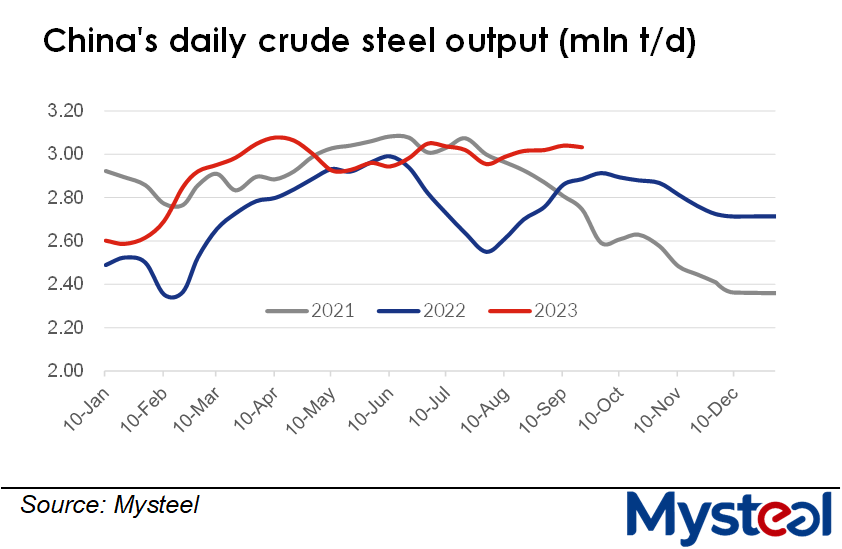

Daily average crude steel output in China retreated slightly during the middle ten days of September, with the tonnage lower by 7,200 tonnes/day or 0.2% from early September to average 3.03 million t/d, according to Mysteel's estimate based on its survey of 247 blast-furnace (BF) and 87 electric-arc-furnace (EAF) steel mills nationwide. The tiny dip nonetheless brought an end to the continuous rise begun in early August, Mysteel Global notes.

The fall in crude steel output during the survey period resulted from some steelmakers halting operations to conduct maintenance, Mysteel Global noted.

Mysteel's other weekly survey showed that over September 8-14, capacity utilization among the 247 BF mills regularly monitored had edged down 0.11 percentage point on week to average 92.65%. At the same time, that among the 87 sampled EAF mills under its tracking also declined by 0.3 percentage point from the prior week to 53.3% on average.

Domestic steel prices in the physical market strengthened over mid-September, as sentiment was improved by the better performance of spot sales, Mysteel Global. Sales picked up because end-users are accumulating steel items ahead of the long Mid-Autumn Day and National Day holidays that start on September 29.

For example, the national price of HRB400E 20mm dia rebar, a bellwether of domestic steel-market sentiment, was assessed by Mysteel at Yuan 3,889/tonne ($533/t) including the 13% VAT as of September 20, increasing by Yuan 90/t from that on September 8.

Over September 11-20, the daily trading volume of construction steel comprising rebar, wire rod and bar-in-coil among the 237 Chinese trading houses under Mysteel's regular survey averaged 152,053 t/d, higher by 11,289 t/d or 8% from the average for early September.

Inventories of the five finished steel products comprising rebar, wire rod, hot-rolled coil, cold-rolled coil and medium plate at traders' warehouses in the 132 cities nationwide under Mysteel's regular survey also totalled 18.3 million tonnes as of September 21, down for the third week and by another 2% thanks to the improved demand.

Source:Mysteel Global