Posted on 14 Sep 2023

ASEAN Economic Performance

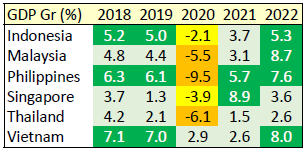

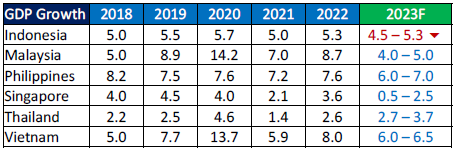

In my previous article on February 2023 edition of the ASEAN Iron and Steel Journal, I highlighted that all ASEAN-6 countries (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) posted a strong growth for the full year of 2022, despite the challenges due to the Ukraine war, volatile commodity prices, high inflation and increasing interest rates environment in 2022.

Now let’s take a look at how the economies have trended since then.

ASEAN-6 Q1 2023 Macro Results

On a quarterly basis, Q1 2023 was still a growth quarter for all ASEAN-6 economies, although expansion was slower (except for Malaysia and Thailand), mainly due to rising interest rates slowing down the economies.

Indonesia’s economy grew by 5.0% in Q1 2023 year-on-year, same compared to Q4 2022.

Growth in Q1 2023 was supported by growth in household & government consumption, offsetting slowdown in investments and export

Construction grew at 0.3% in Q1 2023, much slower than the 1.6% growth registered in Q4 2022.

Manufacturing grew 5.6% and steel related manufacturing industry also expanded. Transportation equipment industry grew +17.3% followed by the base metals industry (+15.5%) and followed by machinery & equipment (+1.0%). The mining sector expanded +4.9%, led by expansion in coal and lignite mining (+17.4%) and oil & gas (+1.0%). Meanwhile metal ore mining sub sector contracted (-16.2%) in Q1 2023.

Malaysia’s economy grew 5.6% in Q1 2023, mainly due to increasing private consumption and investment, despite contractions in government consumption, exports as well as imports.

Private consumption which formed ~60.5% of GDP, was up by +5.9% in Q1 2023, during festive months. Gross fixed capital formation also grew +4.9% with private investment growing +4.7% while public invest-ment grew +5.7%. Note that private investment accounts for 67.1% of total investments.

Government consumption declined by -2.2%. Both exports and imports contracted -3.3% and -6.5% respectively, with in line weakening domestic and external demand.

Construction activities grew at +7.4% in Q1 2023. Expansion was supported by growth in civil engineering (+15.9%), non-residential building (+6.4%) and specialised construction (+6.4%). Residential construction activities declined 3.4%.

Manufacturing grew at a slower pace of +3.2% in Q1 2023 compared to the +3.9% growth last quarter. Steel sector related manufacturing are all under expansion. The motor vehicle and transport equipment cluster grew +8.3%, followed by the fabricated metals (+4.4%), electrical equipment (+2.0%), base metal (+1.6%) and machinery and equipment (+1.1%) clusters.

The mining sector expanded by +2.4% across all mining and quarrying sectors, with other mining & quarrying and supporting services growing at +7.3% followed by crude oil and condense mining at +4.0%.

The Philippine economy expanded +6.4% in Q1 2023, slightly slower that the +7.1% growth in Q4 2022. Growth was mainly driven by:

On the industry side, all economic sectors expanded, except mining and quarrying. The construction sector expanded by +10.8% in Q1 2023, accelerating from +6.3% the quarter before. Most of the value-add growth in construction came from businesses (+20.6%) followed by households (+13.3%) and government (+4.7%).

The manufacturing sector grew by +2.0% in Q1 2023, slowing down from the quarter before. The transport equipment cluster expanded +21.8%, followed by electrical equipment (+6.9%), and basic metals (+6.8%). The machinery and equipment cluster contracted

-13.9%, while the fabricated metal products cluster contracted -5.8%.

The mining sector contracted -2.2% in Q1 2023, led by a huge contraction in the oil & gas cluster (-28.6%), followed by coal mining (-9.6%). Mining of nickel ores cluster expanded +12.3% followed by stone quarrying & others (+6.7%) and gold & precious metals (+4.5%).

The Singapore economy grew by +0.4% in Q1 2023, slower than the +2.1% growth in Q4 2022. All industry sectors expanded during the quarter, except for the manufacturing, wholesale trade and finance & insurance sectors.

The construction sector grew by 7.2% in Q1 2023, slower than the 10.0% growth in the previous quarter. Growth came on the back of expansions in both private and public sector construction works.

Certified progress payments grew by 17.7%, following the 16.8% increase in the previous quarter. Higher certified progress payments came from:

Construction demand (contract awarded) fell by -23.8% year-on-year in Q1 2023, reversing the 8.1% expansion in the previous quarter due to:

The manufacturing sector contracted -5.6% in Q1 2023, extending the -2.6% decline in Q4 2022. The decline was mainly due to the output contractions in all clusters except for the transport engineering cluster.

Output in the transport engineering cluster rose +17.7%, supported by expansions in the:

Thailand’s GDP expanded by +2.7% year on year in Q1 2023, higher than +1.4% a year before.

Private consumption grew +5.4% in Q1 2023, continuing from +5.6% expansion in the previous quarter, due to rebound in the tourism sector and recovery in spending on durable goods. Areas of higher spending was on restaurants and hotels (+108.1%), recreation and culture (+9.8%), transport (+4.9%), clothing & footwear (+4.5%).

Government consumption contracted -6.2%, extending a contraction of -7.1% the quarter before, due to political uncertainly from the upcoming elections.

Fixed investments continued to expand by +3.1%, after a +3.9% growth the quarter before, led by public construction investments (+5.8%), machinery and equipment (+2.6%), private construction investments (+1.1%).

Export grew +3.0% in Q1 2023, driven by exports of services. Exports of goods declined -6.4%. Imports contracted -1.0%, further extending the fall of -4.8% a quarter before, mainly due to the drop in import of goods (-3.3%). Imports of services expanded +8.9%.

On the industry side, the construction sector expanded +3.9%, a further expansion from the growth of +2.6% from a quarter before.

Public construction expanded by +5.8%, following a +3.3% growth in Q4 2022, mainly driven by the government construction (roads and bridges), which rose by +8.3%, accelerating from +0.1% a year before. Meanwhile, the state enterprises construction activities slowed down to +1.3%), significantly decelerating from +11.5% in Q4 2022. State owned enterprises projects in operations includes ongoing construction work on expressway project of the Expressway Authority of Thailand (EXAT), the power distribution system project of the Provincial Electricity Authority (PEA), the mineral exploration project of PTT Exploration and Production Public Company Limited (PTTEP), and work in progress on the other construction of Airports of Thailand Public Company Limited (AOT).

Private construction slowed down to +1.1%, mainly due to slowdown in dwelling construction. Also, non-dwelling construction activities reduced -5.3% across several categories, including industrial plants (-17.4%), commercial buildings (-2.9%).

The manufacturing sector contracted -3.1%, continuing a -5.0% contraction in the previous quarter, mainly due to the weakening external demand.

The mining and quarrying sector declined at -2.4%, extending a drop of -6.9% in Q4 2022, primarily due to the decrease in production of crude oil and natural gas.

The Vietnam economy has been expanding since Q4 2021 hitting a peak of +13.7% in Q3 2022. Since then, the economy has been decelerating. Vietnam’s GDP rose by +3.3% year on year in Q1 2023, decelerating from the +5.9% growth in Q4 2022.

Construction activities rose by +2.0% in Q1 2023, slower than the 6.7% year on year in Q4 2022. The construction sector grew 6 quarters in a row, after a contraction of 10.1% in Q3 2021 when lockdowns of major economic zones hit the economy.

The manufacturing sector contracted slightly at -0.37% in Q1 2023, reversing the +3.0% expansion in Q4 2022.

Manufacturing activities related to the steel and steel consuming sectors performance is shown below (vs Q4 2022):

The mining sector declined 5.6% in Q1 2023, reversing the +5.1% expansion in Q4 2022, led mainly by contraction in the mining support service activities (-18.3%), extraction of crude petroleum and natural gas (-6.0%), mining of coal and lignite (-0.6%). Mining of metal ores subsector expanded +14%, slowing down from a +44% growth last quarter.

ASEAN GDP 2018-2022 and Forecast for 2023

ASEAN-6 governments continue to be optimistic about achieving economic growth in 2023, amid slowing economic growth due to high interest rates. Tight financial conditions, weakening demand, together with escalating geopolitical tensions, high interest rates will continue to weigh heavily on ASEAN economies.

Stay Healthy. Stay Safe.

See You at SEAISI Events.

Source:SEAISI