Posted on 12 Sep 2023

During the week of September 4-8, prices of Chinese hot-rolled coil (HRC) for export declined on week, reflecting the slide in HRC prices in China's domestic market and lacklustre overseas demand for hot coils, sources noted.

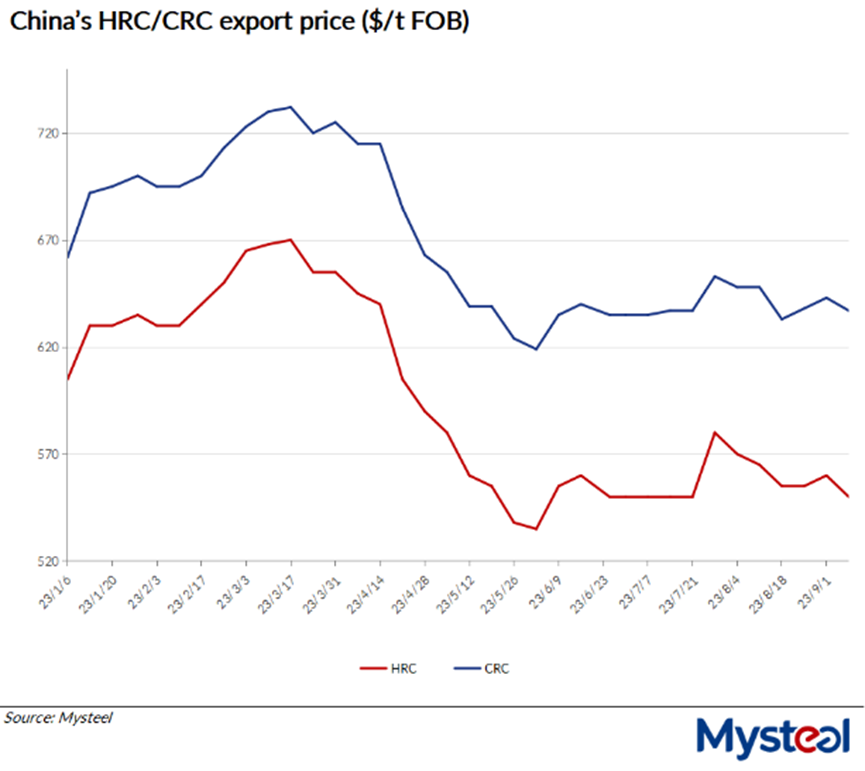

As of September 8, the export price of Chinese SS400 4.75mm HRC under Mysteel's assessment had lost $10/tonne on week to reach $550/t FOB from North China's Tianjin port.

On the same day, Mysteel's assessed export price of SPCC 1.0mm cold-rolled coil had also moved lower by $6/t on week to sit at $637/t, also on FOB Tianjin basis.

The contradiction between high production and low demand for hot coils in China's home market dragged down the spot and futures prices of the flat product last week. This in turn weighed on HRC export quotations, with major Chinese steel producers including state-owned mills cutting their export offering prices for SS400 HRC by $10-20/t on week to $550/t, market sources noted.

Production of the coils during the survey week decreased marginally, with output of hot coils among the 37 flat steelmakers across China regularly monitored by Mysteel remaining a relatively high level of 3.15 million tonnes over August 31- September 6, though this was lower than the previous week's four-month high of 3.2 million tonnes, the latest weekly survey showed.

On September 8, China's national price of Q235 4.75mm HRC under Mysteel's assessment was at Yuan 3,954/t ($539.8/t) including the 13% VAT, down by Yuan 41/t or 1% on week.

Meanwhile, on the same day on the Shanghai Futures Exchange, the most-traded HRC contract for January delivery dropped by Yuan 100/t or 2.6% from the September 1 settlement price to close at Yuan 3,809/t when the daytime trading session ended.

Yet despite the Chinese mills lowering their export offering prices, this failed to result in more export deals, sources pointed out, as steel demand abroad lacks upward momentum and had remained tepid during the week.

For example, in Southeast Asia, Vietnam's major steel group, Hoa Phat Steel, last week tabled its monthly HRC prices for domestic sales at VND 14,190/kg ($589/t) CIF Ho Chi Minh City for late October and early November shipment, down by VND 30/kg on month, according to market sources. But hot coil buyers there were generally disinterested in procuring the flat product and were waiting for other steel giants' quotations, sources added.

Source:Mysteel Global