Posted on 30 Aug 2023

China's exports of hot coils will likely lose ground month-on-month in the second half of this year, due to the combined impact of weakening overseas demand for HRC and narrowing price advantages enjoyed by Chinese steel products, Mysteel's latest flat-products report predicted. Shipments will also be hurt by overseas steelmakers expanding their steelmaking capacity in the future, it notes.

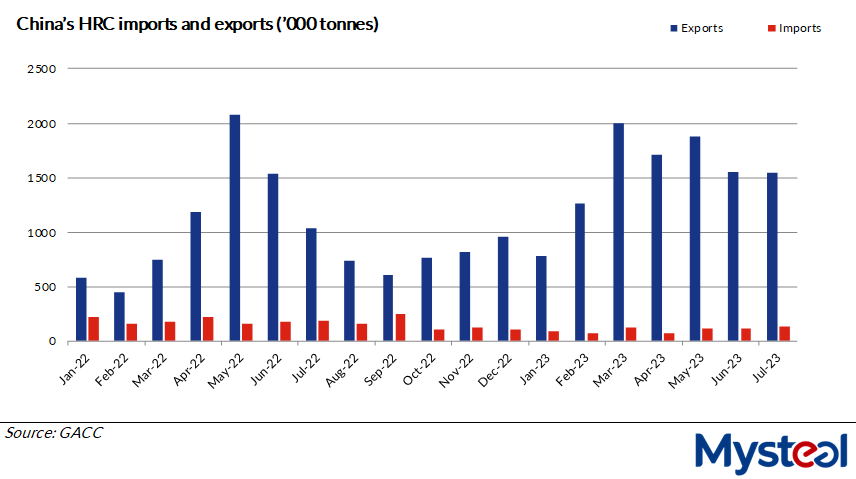

China's HRC exports reached 1.55 million tonnes in July, lower by 0.5% on month but higher by 49.4% on year, according to data released by China's General Administration of Customs (GACC).

Chinese HRC export volumes have cooled to some extent since June this year, despite them being relatively high compared with last year, Mysteel's report pointed out, adding that both overseas inquiries and deals in July for China-origin flat steel products including hot coils turned weak from June.

Chinese HRC export volumes have cooled to some extent since June this year, despite them being relatively high compared with last year, Mysteel's report pointed out, adding that both overseas inquiries and deals in July for China-origin flat steel products including hot coils turned weak from June.

Weakening overseas steel consumption was one of the major reasons for the slump, a Shanghai-based analyst explained. Moreover, steel demand among foreign buyers will continue to decline this half, which will further dampen China's HRC export business, he said.

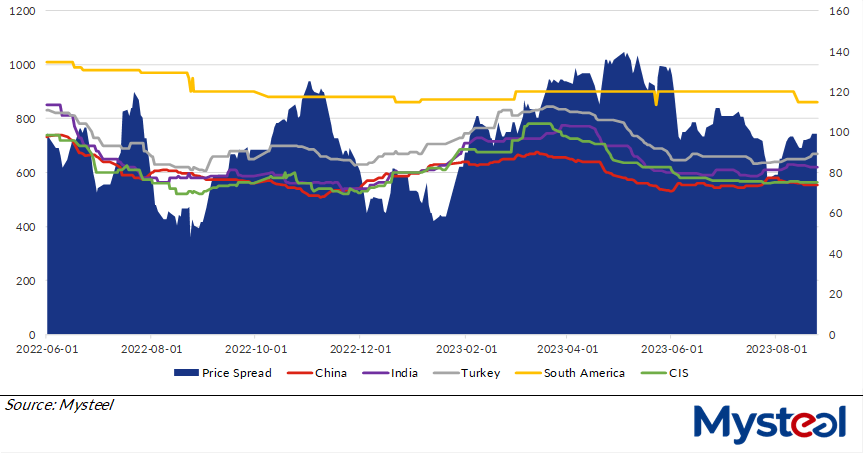

Another major reason was the narrowing price spread between China-origin HRC and overseas competitors' hot coils, the report noted.

For example, as of August 28, the price spread between China's export price of SS400 HRC and that of other major HRC exporters was $97/tonne, lower by $11/t or 10.2% from June 30 this year, according to Mysteel's assessment.

Besides, China's domestic prices of steel products including hot coils may find some support should steel output decline in the months ahead, the analyst noted. "In such a case, a sharp fall in Chinese export prices of hot coils is unlikely."

Many Chinese steel producers may reduce their steel output in coming months to comply with China's policy of keeping crude steel output this year at or below 2022 totals, as Mysteel Global reported.

China's HRC export price VS average HRC export price of major countries ($/tonne, FOB)

Looking ahead, steelmakers in the ASEAN-6 countries – Vietnam, Indonesia, Malaysia, Thailand, the Philippines and Singapore – are continuously expanding their steelmaking capacity, which will also put pressure on China's steel exports, the report warned.

Numerous steel projects have been launched in Southeast Asia in recent years, and about 15 new steel projects with a total steelmaking capacity of approximately 82.2 million t/y will be put into operation in the region in the next three to five years, as Mysteel Global reported.

As such, total crude steel output in the ASEAN-6 is expected to reach 90 million tonnes in 2023, Mysteel predicted in another report.

"The price advantages enjoyed by China's steel product exports may be transferred to the ASEAN region in the future," the analyst said.

However, despite the negative factors ahead, China's total finished steel exports may rise by 1%-4% on year to sit at 68-70 million tonnes in 2023, the report predicted, considering that the country's steel exports had already reached 50.89 million tonnes over January-July, according to the GACC data.

Source:Mysteel Global