Posted on 22 Aug 2023

Prices of Chinese hot-rolled coil (HRC) for export have lost ground during the week of August 14-18, mainly due to the continuing weakness of overseas demand for hot coils, market watchers observed.

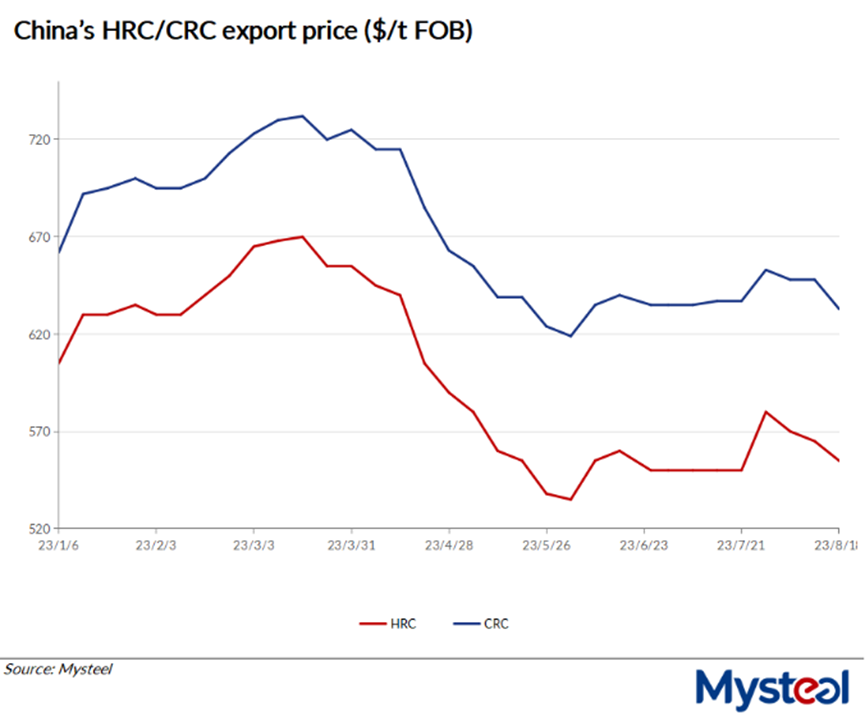

As of August 18, the export price of Chinese SS400 4.75mm HRC under Mysteel's assessment eased by $10/tonne on week to sit at $555/t FOB from North China's Tianjin port.

By the same day, Mysteel's assessed export price of SPCC 1.0mm cold-rolled coil declined too, down by $15/t on week to $633/t, also on FOB Tianjin basis.

Considering overseas buyers' still-weakening demand for Chinese hot coils, some leading steel producers in China shaved their export quotations for SS400 HRC last week, cutting the prices by $30-50/t from the prior week to $540-560/t FOB for October shipment, sources noted.

In the Middle East market, China-origin SS400 HRC hot coils were offered at $590/t CFR, giving Chinese exporters a price edge, as compared with quotations above $600/t CFR from Japan and South Korea, sources added.

Nevertheless, transactions of China-origin hot coils for October delivery didn't increase significantly there, a local trader found, explaining that most buyers in the Middle East had already bought quite a lot of Chinese cargoes in the past few months, which lifted their stocks of the flat steel product to some extent.

Besides, new arrivals of imported cargoes at ports also left local buyers in no hurry to place orders for October shipment, he added.

Elsewhere in the Southeast Asia, leading Vietnam steel producer Formosa Ha Tinh Steel (FHS) last Friday cut its domestic SAE1006 HRC prices by $15/t to $610/t CIF Ho Chi Minh City (dollar equivalent) for late September and early October shipments, considering lower Chinese offers and weak demand for steel products in Vietnam.

The price cut was just four days after the steel mill had lifted its home HRC prices by $20/t earlier on August 14, according to market sources.

Source:Mysteel Global