Posted on 16 Aug 2023

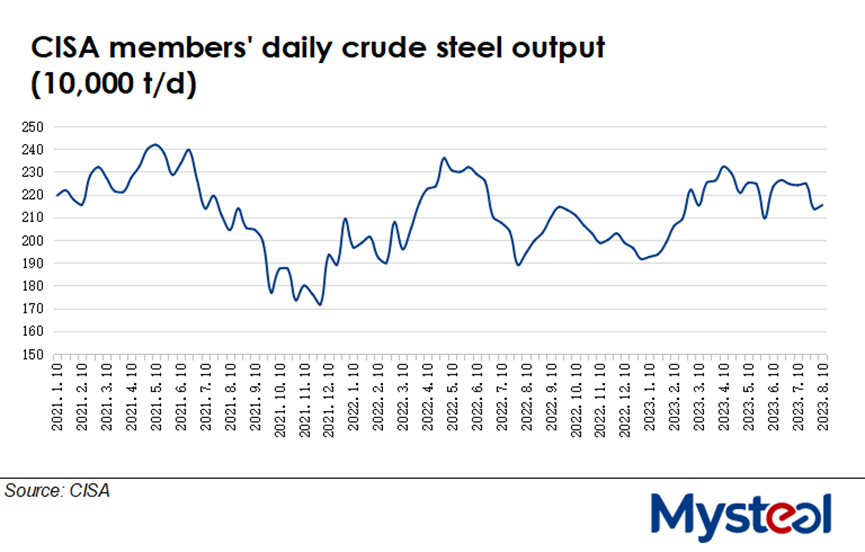

During the first ten days of August, daily crude steel output among member mills of China Iron and Steel Association (CISA) reversed up by a small 0.8% or 17,100 tonnes/day from late July to average 2.15 million t/d, according to CISA's latest release on Monday.

Behind the rebound in daily output was the fact that blast furnaces among some mills in North China's Tangshan were gradually brought back on stream earlier this month after local authorities had lifted the production curbs imposed on them to reduce air pollution, sources said.

Based on the latest result, CISA estimated the country's daily crude steel output over August 1-10 at 2.95 million t/d, higher by 0.7% from the last 11 days of July.

Mysteel's survey among the 247 Chinese blast-furnace and 87 electric-arc-furnace mills it monitors generally mirrored the CISA findings, as their production increased by 1.1% or 33,000 t/d from late July to average 2.99 million t/d in early August, as reported.

As of August 10, the member mills' finished steel stocks had mounted by 10.8% or 1.6 million tonnes from July 31 to reach 16.1 million tonnes, according to CISA data. This was mainly because steel demand had been dampened by high temperatures in many regions across China and intense rains and floods in the northern parts of the country.

Mysteel's survey among the 237 Chinese steel trading houses it tracks showed that their daily trading volume of construction steel comprising rebar, wire rod and bar-in-coil averaged 132,034 t/d over August 1-10, falling by 11.5% or 17,230 t/d from that for late July.

Meanwhile, Chinese steel prices lost some further ground in early August, with the national price of HRB400E 20mm dia rebar, a barometer of the country's steel-market sentiment, being assessed by Mysteel at Yuan 3,770/tonne ($518/t) including the 13% VAT by August 10, slumping by Yuan 116/t from the end of July.

Source:Mysteel Global