Posted on 09 Aug 2023

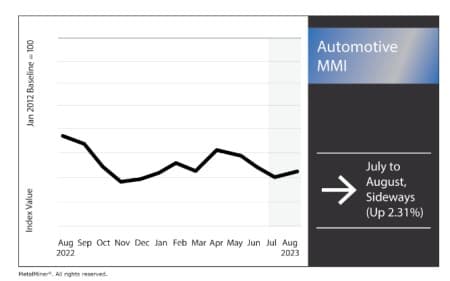

Compared to other metal industries, components of the automotive industry still remain somewhat strong, despite the Automotive MMI (Monthly Metal Index’s) sideways movement over the past seven months. Pent-up consumer demand still runs strong in the industry. However, it still continues to battle high interest rates and falling steel prices due to slumping demand. There could potentially be a swing to the upside in the long-term should the Fed begin lowering interest rates. However, most experts don’t anticipate that will happen until at least 2024. Until the Fed goes dovish, the index could remain somewhat sideways. All-in-all, the Automotive MMI moved sideways, rising up by 2.31%.

The ongoing microchip shortage is significantly impacting the automobile sector in the U.S., particularly in the production of electric cars (EVs). Automakers have faced shortened production schedules and suffered huge financial losses since the chip shortage began. The scarcity is projected to result in cutting 2.8 million global vehicles for the year 2023, a stunning figure that highlights the seriousness of the crisis. Chip scarcity has been a significant impediment for organizations in numerous industries, with automakers being among the most affected.

While consumer electronics manufacturers account for approximately 50% of microchip supply, automakers account for approximately 15% of supply. As passenger vehicles become more technologically advanced, they continue to rely more and more on microchips.

Despite the global chip scarcity, more manufacturers are prepared to cut prices in order to qualify for the EV tax credit. This may end up making EVs more affordable. However, buyers may have to wait for some time before they can purchase brand-new EVs at a more affordable rate. Due to the continued chip shortage, automakers will eliminate about 18 million vehicles from production plans by the end of 2023. According to Ford’s Chief Financial Officer, John Lawler, “there is still going to be volatility around chips” in 2023. “It’s easing,” said Sam Fiorani, Auto Forecast Solutions’ vice president of global vehicle forecasting. “There are more chips out there, and if you have proper access to them, your production will be fine.”

Steel prices still currently find themselves in a sideways market, with prices only recently beginning to witness more movement. Sideways movement in steel prices can benefit the automotive sector in the following ways:

Any major changes or sideways movement in steel pricing, on the other hand, can have a detrimental influence on the automotive sector. If steel prices break out of their sideways trend, the automotive market could experience the following:

It should be noted that these negative consequences may not be instantaneous or universal across the whole automotive industry. The magnitude of the impact varies based on factors such as the magnitude of steel price swings, market conditions, and individual automakers’ tactics for mitigating the consequences of steel price movements.

Source:Oil Price