Posted on 17 Jul 2023

Rebar output among the 137 Chinese steelmakers under Mysteel's regular survey declined during July 6-12 after rising for the previous three weeks, slipping by a tiny 0.4% or 11,400 tonnes on week to reach 2.76 million tonnes. Shrinking profits from the retreat in domestic steel prices, plus the need among many mills to conduct routine maintenance, largely accounted for the slide, survey respondents said.

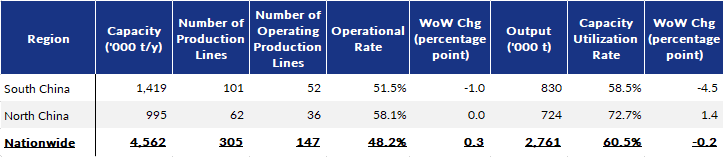

The survey results showed significant on-week declines in rebar output among mills located in Southwest China's Sichuan, Central China's Henan and Northeast China's Liaoning.

During the survey week, the average capacity utilization rate and operational rate of the bar mills installed at the surveyed producers showed some disparity, with the former reversing down from three weeks of gains, lower by 0.2 percentage point on week to 60.5%, while the latter rose for the second week, up 0.3 percentage point on week to 48.2%, Mysteel's data showed.

Domestic steel prices had softened recently due to weak fundamentals, as reported. As of July 13, the country's national price of HRB400E 20mm dia rebar, a weathervane of the domestic steel-market sentiment, was assessed by Mysteel at Yuan 3,813/tonne ($534/t) including the 13% VAT, dropping by Yuan 40/t from a week earlier.

China's steel demand remained dull as the summer heat is impacting work on construction sites. The spot trading volume of construction steel including rebar, wire rod and bar-in-coil among the 237 traders Mysteel samples stayed largely stable on week at 146,389 tonnes/day over July 7-13, inching up 329 t/d or 0.2% on week.

Meanwhile, rebar inventories at the 137 surveyed mills reversed up by 3.5% or 68,800 tonnes on week to around 2 million tonnes as of July 12. The tonnes stocked at the commercial warehouses in the 35 Chinese cities Mysteel checks regularly grew for the third successive week, rising by 0.5% or 30,500 tonnes on week to 5.6 million tonnes as of July 13.

Table 1: Rebar Production Survey by Region by Jul 12

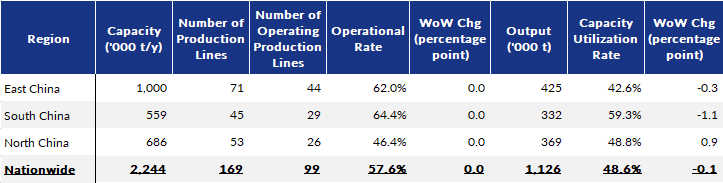

Table 2: Wire Rod Production Survey by Region by Jul 12

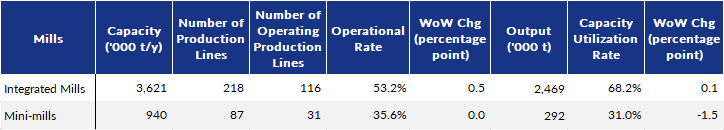

Table 3: Rebar Production Survey by Process by Jul 12

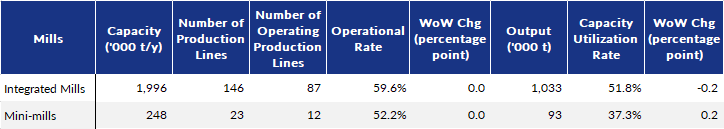

Table 4: Wire Rod Production Survey by Process by Jul 12

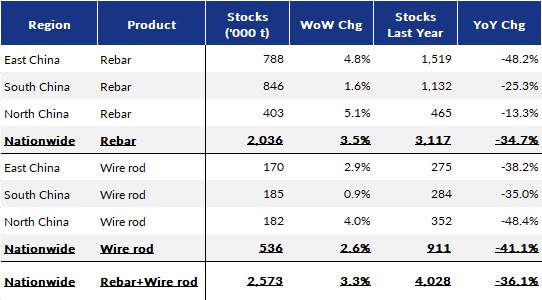

Table 5: Mills' Rebar and Wire Rod Stocks by Region by Jul 12

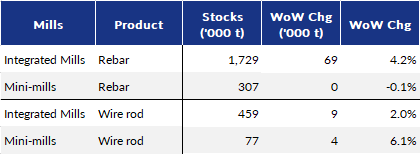

Table 6: Rebar and Wire Rod Stocks Survey by Process by Jul 12

Source:Mysteel Global