Posted on 12 Jul 2023

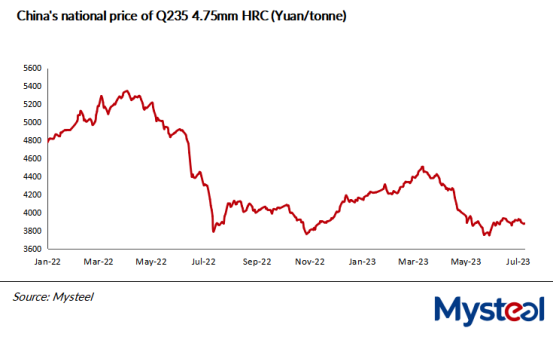

China's market for hot-rolled coil (HRC) is forecast to recover during the second half of this year, with the overall HRC price being slightly higher than the average during January-June, Mysteel predicted in its latest report on the key steel item.

During this year's first half, China's hot coil market rose initially as the recovered demand for HRC lifted market sentiment generally over January to April, the report noted. However, as the half progressed the market for coils was dragged down by the early arrival of high temperatures and heavy rains in many regions of the country which impacted the activities of steel end users and logistics firms.

Although downstream demand for Chinese HRC remains lackluster currently, the market has bottomed and is showing signs of stabilizing. During the present July-December half, conditions for hot coils are expected to improve once summer ends, the reported explained, adding that new economic stimulus policies from the central government should also aid a market pickup.

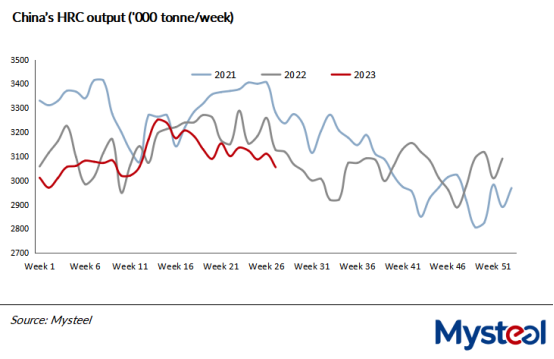

On the supply side, Chinese steel producers are expected to raise their hot coils output in H2 to benefit from recovering profits, the report pointed out.

Meanwhile, downstream demand for hot coils is seen improving this half, especially that from the real-estate development sector, assuming that stimulus policies are announced as expected.

In addition, the automotive sector will remain strong thanks to car purchase subsidies and some other supportive policies for new energy vehicles, the report noted, while the extreme weather will also drive demand for white goods, mainly due to the emergence of the El Niño phenomenon this year. Both these trends will lift demand for cold rolled coils, surface treated sheets and electrical sheets – all of which will require HRC as the mother coil.

Against the backdrop of relatively strong supply and demand, the overall price of Chinese HRC may perform better in H2. Indeed, the price peak will be higher than in the first half of the year, and the fluctuation range will be smaller, the report suggested.

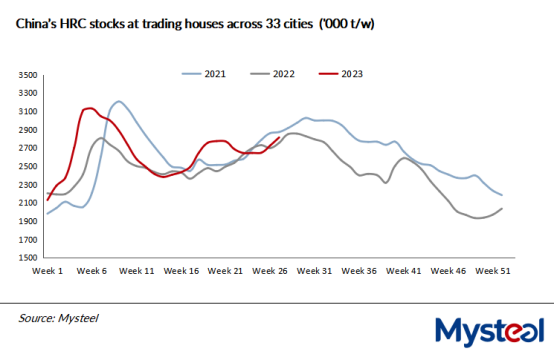

In addition, the relatively low level of HRC stocks is also expected to provide some support to hot coil prices in H2, the report added.

Review and forecast of Chinese HRC fundamentals

Year | Output | Capacity utilization | Apparent Consumption (mln t) |

2021 | 254.9 | 71.49% | 246.9 |

2022 | 258.8 | 72.55% | 250.3 |

2023E | 269.8 | 73.76% | 261.7 |

Source: Mysteel

Source:Mysteel Global