Posted on 07 Jul 2023

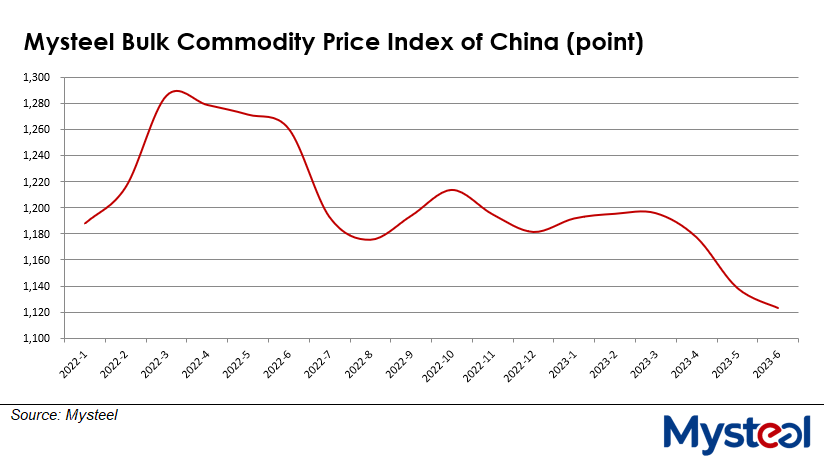

The Mysteel Bulk Commodity Price Index of China (MyBCIC) slid further during June, down by 1.4% on month or 10.9% on year to reach 1,122.8, according to Mysteel's latest report. Nevertheless, though the index has been losing ground since April, the pace of the decline in June had narrowed from May, Mysteel Global noted.

Covering prices in nine Chinese industries -- steel, energy, non-ferrous metals, basic chemicals, rubber and plastics, construction materials, papermaking, textiles, and agricultural products -- the MyBCIC serves as a gauge of domestic bulk commodity market health.

By industry, the sub-indices of non-ferrous metals and textiles rose during June while those of the remaining seven posted on-month declines. However, comparing their performances during June last year, all nine industries logged on-year drops in their respective price indices last month, Mysteel Global noted.

By industry, the sub-indices of non-ferrous metals and textiles rose during June while those of the remaining seven posted on-month declines. However, comparing their performances during June last year, all nine industries logged on-year drops in their respective price indices last month, Mysteel Global noted.

The persistently challenging marco-environment globally continued weighing on China's bulk commodity market in June, Mysteel's report observed. "The world's major advanced economies are still under high inflationary pressure and remain on a path of monetary tightening. Meanwhile, the Chinese economy is grappling with a weaker-than-expected recovery and other uncertainties."

On the other hand, prices of major bulk commodities in China were also impacted by their own fundamentals, the report pointed out.

For example, in June, the MyBCIC's sub-index for steel dipped 0.4% on month or 16.7% on year to reach 930.4, largely due to the domestic steel market's sagging fundamentals.

Mysteel's regular survey among 184 Chinese steel mills nationwide showed that over June 22-28, their total production of the five major steel products of rebar, wire rod, hot-rolled coil, cold-rolled coil and medium plate had risen for the third straight week to reach 9.41 million tonnes.

In sharp contrast to the continuing rise in domestic steel output is the constant softening of demand, as June signals the start of the country's usual off-season for steel use in summer.

During the same survey week ending June 28, Mysteel calculated that total consumption of the five major carbon steel items had decreased for five weeks to reach 9.05 million tonnes, as against the 9.88 million tonnes recorded at the start of June.

Looking ahead, China's bulk commodity market is likely to remain under downward pressure this month from both macro-economic factors and commodity fundamentals, with the MyBCIC continuing to fluctuate, Mysteel's report predicted.

"The European Central Bank has signalled another interest rate hike to come this month in its ongoing fight against inflation. Elsewhere, market expectations are mounting for the US Federal Reserve to further lift its benchmark interest rate this month after it skipped a rate hike in June," the report said.

Weaker-than-anticipated global growth prospects are also slowing the momentum of Chinese exports, the report added. "Domestically, both supply and demand for major commodities may remain dull this month. But commodity market commentators still hope that more stimulus measures will be introduced by the central government in the near term."

The Political Bureau of the Communist Party of China (CPC) Central Committee will convene in late July to study and analyse current economic circumstances and make plans for related work for the second half of this year, Mysteel Global notes.

Source:Mysteel Global