Posted on 04 Jul 2023

Chinese steel prices will find upward momentum from the central government's likely introduction of new economic stimulus policies this month, though the steel market's weakening fundamentals threaten to be a drag, Mysteel's chief analyst Wang Jianhua predicts in his latest monthly outlook. Last month, domestic steel prices had rebounded overall, generally recovering all the ground lost in May, Mysteel's survey showed.

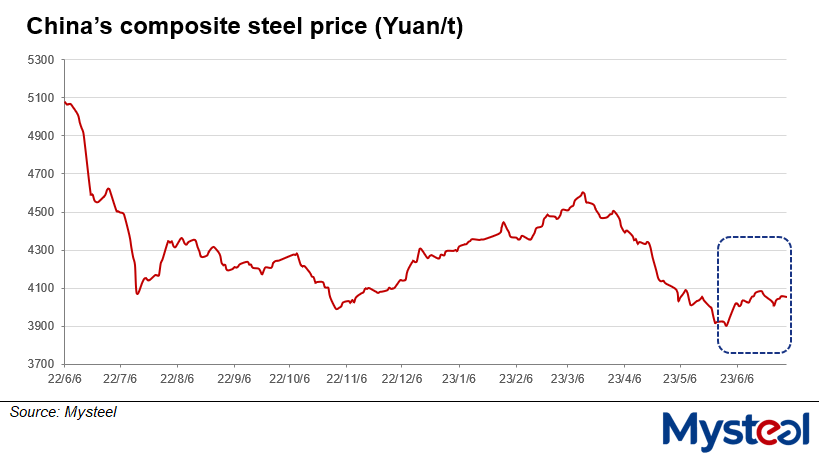

As of June 30, China's composite steel price under Mysteel's assessment was at Yuan 4,059/tonne ($559/t), higher by Yuan 156.7/t or 4% from May 31. The price recovery was driven mainly by the bullish market sentiment, according to Wang.

During last month, a package of incentive policies had been introduced by the central government to lift the domestic economy, as Mysteel Global reported, including a reduction in lending rates, the accelerated issuance of special treasury bonds, and the extension of tax breaks on purchases of new energy vehicles. As all the measures would directly and indirectly benefit the steel industry, the outlook for the domestic ferrous market became more optimistic.

During last month, a package of incentive policies had been introduced by the central government to lift the domestic economy, as Mysteel Global reported, including a reduction in lending rates, the accelerated issuance of special treasury bonds, and the extension of tax breaks on purchases of new energy vehicles. As all the measures would directly and indirectly benefit the steel industry, the outlook for the domestic ferrous market became more optimistic.

The central government will continue to enhance the policy support in the above fields this month, Wang believes, because "economic growth in the second half of the year depends on the strength of the start in July."

The shortage of funding liquidity is one of the principal problems undermining China's economy, even though monetary policy has been loosened significantly, he pointed out.

For example, by the end of May, the average payback period of the accounts receivable among sizable domestic industrial firms reached 63.6 days, stretching by 0.5 day on month and 6.4 days on year, according to a release from the country's National Bureau of Statistics (NBS).

"The introduction of key stimulus policies should not be delayed any longer," Wang said. "It takes time for the measures to come into real effect among the numerous enterprises throughout China," he explained.

In fact, the central government gave many signals in June implying that Beijing would soon roll out more policies to expand domestic demand and restore market activity, Mysteel Global learned. "The implementation of new policies will improve macroeconomic expectations and give a further boost to Chinese steel prices," Wang predicted.

However, domestic steel prices will come under heavier pressure from market fundamentals in July as supply is quite ample while demand will weaken due to the high temperatures and intensifying monsoon rains in summer, Wang warned.

Mysteel's survey showed that over June 23-29, the daily hot metal output among the 247 steel mills operating blast furnaces had increased to 2.47 million tonnes/day, hitting a new high since early March 2021.

Though the wider margins encouraged steelmakers to produce vigorously last month, the output increment will translate to growth in steel inventories this month, Wang noted.

As of June 29, total inventories of finished steel products held by steel mills and traders across 35 cities under Mysteel's monitoring had ended their previous seven-week decline and started to mount, rising 2.3% on week to 15.8 million tonnes. According to Mysteel's assessment, the stocks are likely to increase by some 1.5 million tonnes overall during July, exerting greater pressure on steel prices.

On the other hand, Wang expects that steelmakers will rein in production this month, which will reduce the consumption of steelmaking raw materials and cause their prices to lose ground. This in turn would lead the cost support for steel prices to waver as well.

In the intensifying tussle between the recovering macro economy and the weakening steel fundamentals, Chinese steel prices will fluctuate this month, having room to both rise and fall, Wang concluded.

Source:Mysteel Global