Posted on 02 Jun 2023

Thoughts of gloom, just shy of despair, kept Chinese steel prices tracking south throughout last month and are likely to continue dragging steel prices lower in June, Mysteel's chief analyst Wang Jianhua predicts in his monthly outlook. His hopes rest on the central government introducing new stimulus policies to lift the domestic economy, he said.

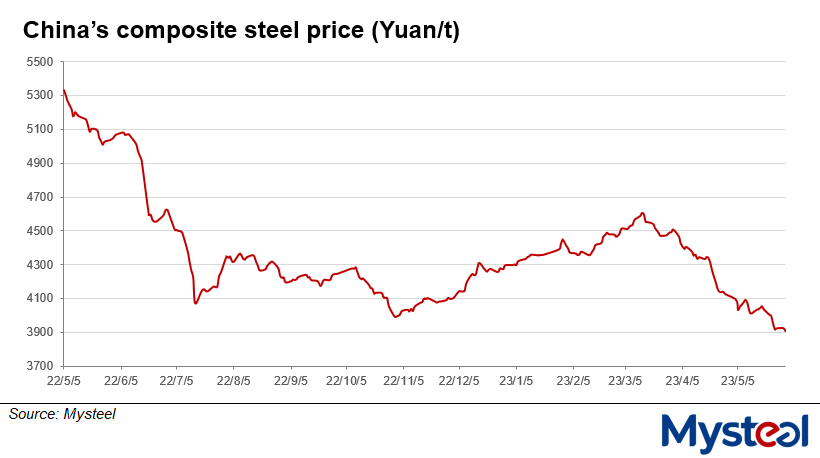

After sliding steadily during the previous two months, China's composite steel price under Mysteel's assessment as of May 31 had lost Yuan 224.4/tonne ($31.6/t) or 5.4% from April 28 to settle at Yuan 3,903/t – a new low since July 8 202.

"Recently, it has become increasingly obvious that China's ferrous market fully concurs with the BANI concept – its brittle, anxious, non-linear, and incomprehensible – with bearish news from various sources spreading at home and abroad," Wang pointed out.

Over May 1-26, Mysteel's indices of market sentiment for China's major carbon steel products had all stayed far below 50 throughout the period, a pattern rarely seen previously in May, even though traditionally, May is a slack month for steel consumption, Wang observed. This indicates that market participants were extremely pessimistic last month, he stated.

Average market sentiment indexes of major steel products in May

Year | Construction steel | Hot-rolled Coil | Cold-rolled coil | Medium plate | Wire |

2020 | 63.41 | 60.74 | 61.72 | 58.58 | 63.21 |

2021 | 56.92 | 57.37 | 60.60 | 55.52 | 54.65 |

2022 | 51.97 | 57.54 | 56.20 | 56.61 | 47.45 |

2023 | 24.74 | 32.75 | 24.61 | 34.25 | 29.11 |

"The bearish factors, whether proven real or not, were all taken in by market participants last month," Wang commented. "The US debt crisis, the possible US interest rate rise in June, the persistent drop of Chinese coal prices, and domestic property risks all sent steel prices lower," he maintained.

Moreover, that the pessimism will ebb soon seems unlikely, as macroeconomic data released during the past month still reflected the lack of momentum for growth in domestic steel demand, Wang suggested.

For example, China's Purchasing Managers' Index for the manufacturing industry in May had slipped for the third straight month by another 0.4 index point on month to 48.8 and staying in the contraction zone, according to a release from the country's National Bureau of Statistics (NBS).

Other NBS data also showed that by the end of April, the accounts receivable among China's sizable industrial firms had jumped 12.6% on year to Yuan 21.9 trillion, with the average payback period stretching by another 6.4 days on year to 63.1 days.

"The companies don't have enough money to launch new industrial projects since it is getting harder for them to collect payments," Wang explained. "This will seriously curb domestic steel consumption and may even lead to deflation in the country," he warned.

Under such circumstances, China's central government is expected to introduce new incentive policies to stimulate consumption and help to restore consumer confidence, Wang believed.

"Measures such as issuing special bonds, lifting property purchase limits, and reducing interest rates will all be conducive to boosting market sentiment," he said, stressing that the recovery of confidence is the key to the rebound of ferrous prices.

Once market sentiment turns positive, steel traders and end-users will start replenishing their steel inventories, which will likely result in shortages of certain products, according to Wang.

As of May 31, the inventories of finished steel products held by steel mills and traders across 35 cities under Mysteel's monitoring had dropped 14% from May 3 to hit 16.8 million tonnes, lower by a large 22.3% on year. Specifically, the stocks of rebar totalled 8.1 million tonnes, falling 17.8% on month and slumping 30.6% on year.

Wang attributed the large drop in steel inventories to the rise in exports as China-origin steel now has price advantages. During January-April, China's steel exports jumped 55% on year to total 28 million tonnes, according to statistics from the country's General Administration of Customs.

As the production pace of many overseas steelmakers remains relatively slow, Chinese steel exports will probably remain high this month, Wang noted. As such, domestic steel stocks are likely to keep falling in June, though the pace of the decline may slow, he predicted.

Source:Mysteel Global