Posted on 01 Jun 2023

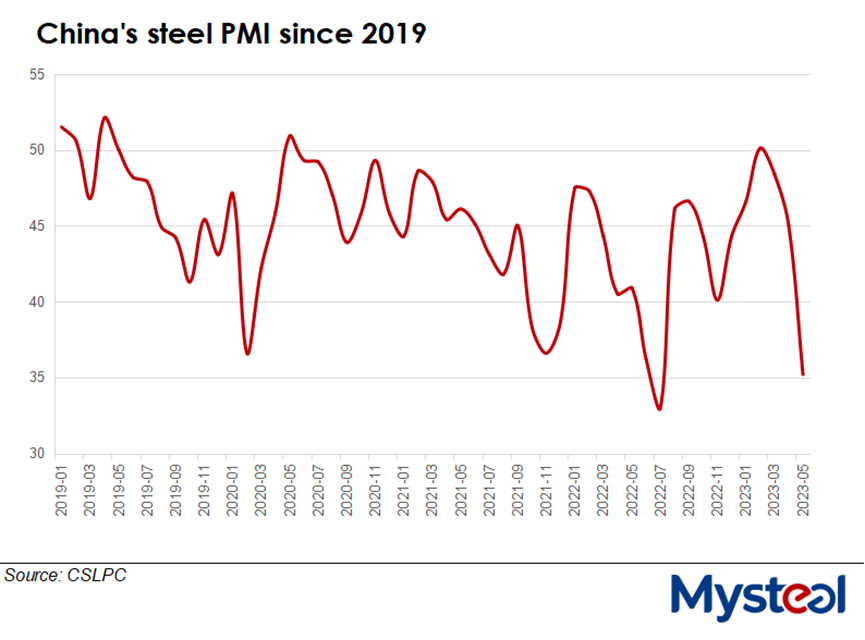

China's Purchasing Managers' Index (PMI) for its steel industry in May declined for the third month and at a faster pace, tumbling 9.8 percentage points from April to a ten-month low of 35.2, as demand remained low, steel production fell further, and prices of both steelmaking raw materials and finished steel trended downwards, the official index compiler, CFLP Steel Logistics Professional Committee (CSLPC), announced on Wednesday.

For May, the sub-index for new steel orders including domestic sales and exports shrank for the second month, sliding by 12.5 percentage points on month to just 27.4, mainly due to China's slack property development market and the slowdown in infrastructure construction, according to CSLPC.

A headline PMI number above 50 indicates respondents believe the industry is expanding compared with the previous month, while a reading below 50 connotes contraction, Mysteel Global notes. The further fall in May suggests surveyed firms are even more pessimistic about the steel sector's overall performance than they were in April.

China's sub-index of steel production decreased for the second month too, the results show, plunging by 19.7 percentage points on month to 27.5 this month. But the committee pointed out that some domestic steelmakers had gradually resumed production after conducting maintenance on blast furnaces during the early part of this month.

"It is noteworthy that the production sub-index has been higher than the new orders sub-index for seven successive months," CSLPC observed. "The pace at which demand is contracting has been persistently faster than that of (the reduction of) production, and the contradiction between them has emerged," it said.

Daily crude steel output among the member mills of the China Iron and Steel Association (CISA) dipped by 0.2% from early May to average 2.25 million tonnes/day in mid-May, CSLPC noted, quoting CISA data.

In May, raw materials prices showed substantial declines due to softening demand caused by the falls in mills' production. Consequently, the sub-index for steelmaking raw material procurement prices scored 18.4, or down further by 18.3 percentage points on month, with prices of iron ore and coke both declining, according to the release.

"For June, domestic steel demand may weaken further due to the hot weather in summer – the off-season for steel consumption – and the infrastructure and real estate sectors are also unlikely to see a significant recovery in the short term," CSLPC acknowledged.

Moreover, "mills may be pressured by production curtailment during June," according to the committee, adding that "raw materials prices may keep softening and steel prices may be rangebound at low levels." China's central government is pressuring the steel industry to ensure that crude steel production this year does not exceed that for last year, as Mysteel Global has reported.

Source:Mysteel Global