Posted on 05 May 2023

The pessimism prevailing in China's ferrous markets last month sent steel prices nationwide on a steep slide that will continue this month and only end when market participants regain their confidence, Mysteel's chief analyst Wang Jianhua predicts in his monthly outlook.

"However, the sharp and rapid price drop is not necessarily bad, because it's the only way to drag down raw materials prices and force steelmakers to cut production," Wang stated. "This could lay a more solid foundation for the recovery of prices later," he added.

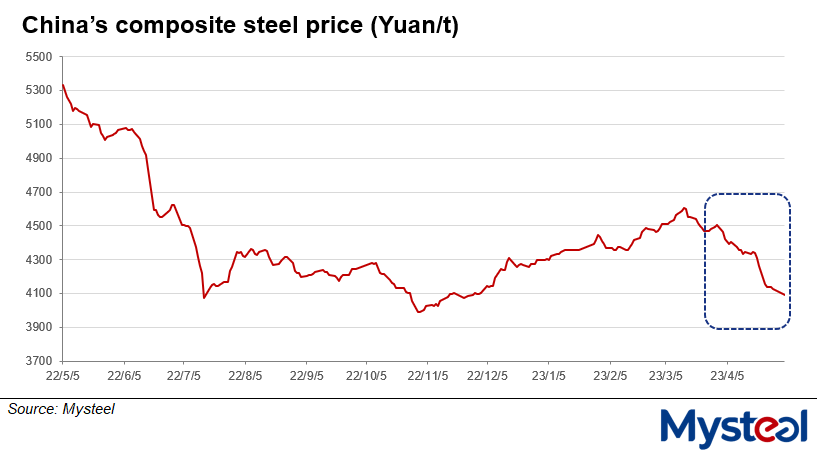

As of April 28, China's composite steel price under Mysteel's assessment had settled at a more than four-month low of Yuan 4,128/tonne ($598.2/t), falling by a large Yuan 380.2/t from March 31.

The slower-than-expected recovery of steel demand from the domestic construction industry was a main drag on Chinese steel prices last month, Wang noted.

The slower-than-expected recovery of steel demand from the domestic construction industry was a main drag on Chinese steel prices last month, Wang noted.

The Purchasing Managers Index (PMI) tracking new orders in China's construction industry registered 50.2 for March, slumping 11.9 basis points on month, according to data released by the country's National Bureau of Statistics (NBS).

"The figure this time was very abnormal because usually the new order index would rise to a level much higher than 50 in March," Wang pointed out. The drop in the new order PMI foreshadowed the feeble growth of steel demand in subsequent months, so the price slump last month should not be a surprise, he remarked.

Meanwhile, Chinese steelmakers' strong production performance was also weighing on prices, according to Wang. NBS data released in mid-April showed that China's daily crude steel output had averaged 3.09 million tonnes/day in March, a new monthly high since June 2022.

"This translates to an annual output of crude steel this year of 1.12 billion tonnes – far beyond the market's capacity for consumption," Wang said.

The mismatch between actual supply and demand has triggered pessimism in the steel market and forced domestic mills to rein in production, Mysteel Global learned. However, the output reductions being observed currently are not enough, Wang warned.

As of April 26, more than 40 Chinese steelmakers had announced plans to stop blast furnaces for maintenance, according to Mysteel's tracking. If the units are stopped as planned, this would reduce total hot metal output among the 247 sampled steel mills to some 2.38 million tonnes/day in May, lower by around 70,000 t/d on month.

"But steel prices would not gain any firm support until the daily output drops below 2.33 million t/d," Wang argued. "The mills reducing steel output now is like squeezing toothpaste from a tube – it's too slow to stop the slide in steel prices," he suggested.

In this scenario, prices of most steel products are likely to keep falling until they near the lowest level in the past two years, Wang predicted. Just this week, China's national price of HRB400E 20mm dia rebar had dropped to Yuan 3,859/t on May 4, a new low since October 30 2020, according to Mysteel's assessment.

"There is little chance that domestic steel demand will show any marked improvement in May, so the steel mills must cut their production more intensively if they want to see a sustainable recovery in steel prices," Wang stressed. "The mills cannot make healthy profits until steel supply and demand return to balance once again," he said.

Source:Mysteel Global