Posted on 05 Apr 2023

India's coking coal imports rose to a four-month high in January as competitive premium hard coking coal prices bolstered year-end buying interest.

January arrivals in India increased by 24pc on the year and by 1pc on the month to 4.74mn t, according to data from e-commerce firm Mjunction.

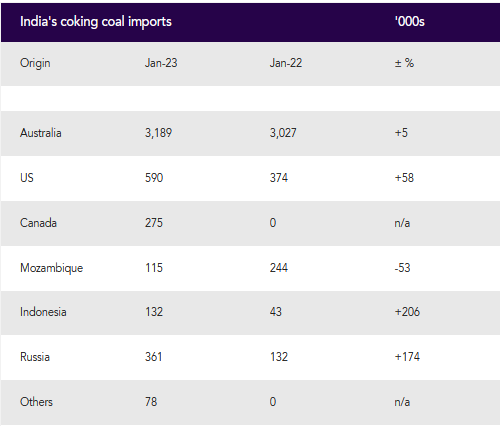

Shipments from Australia accounted for the bulk of Indian coking coal imports, rising by 5pc on the year to 3.19mn t. But Australian shipments fell by 1pc on the month because of some delivery delays. Higher deliveries from the US, Canada and Russia also boosted India's January arrivals.

Steel production in India declined slightly by 0.2pc on the year to 10.9mn t in January, according to data from the World Steel Association. But automobile production in India increased in January in response to strong demand for passenger vehicles. Private-sector steel mill JSW increased its January production of crude steel, while fellow Indian producer Tata Steel expected steel demand and prices to rise over January-March because of sustained government spending on infrastructure.

India's metallurgical coke imports stood at 359,248t, up by over twofold from a year earlier but down by 11pc on the month. China was the top supplier, with its deliveries of 109,727t more than doubling on the month and up from zero a year earlier. India's January pulverised coal injection imports slumped by 12pc on the year and by 25pc on the month to 1.09mn t as seasonal winter delays slowed offers from Russia.

The Argus premium low-volatile hard coking coal index averaged $329.59/t cfr east coast India in January, up by 17.4pc from an average of $280.74/t cfr east coast India a month earlier but down by 23pc on the year.

Argus last assessed Australian premium low-volatile hard coking coal prices at $299.50/t fob Australia on 3 April, down by 51pc on the year and by 19pc on the month.

Source:Argus Media