Posted on 03 Apr 2023

2022 Macroeconomics Results

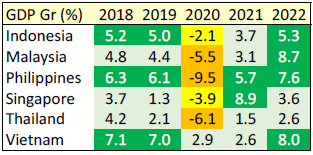

All ASEAN-6 countries (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) posted a strong growth for the full year of 2022, despite the effects of the Ukraine war, volatile commodity prices, high inflation and increasing interest rates environment over much 2022.

GDP growth for all ASEAN-6 countries also posted economic growth at or better than 2019 figures, signalling that economies are now back on a growth path.

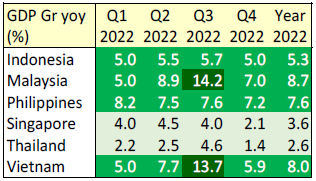

How the economies have trended over 2022 can been seen from the quarterly results

ASEAN-6 Q4 2022 Macro Results

On a quarterly basis, Q4 2022 was still a growth quarter for all ASEAN-6 economies, although expansion was slower due to high commodity prices and rising inflation.

Indonesia’s economy grew by 5.0% in Q4 2022 year-on-year, slower growth compared to Q3 2022.

Growth in Q4 2022 was supported by

However, Government consumption declined by 4.8%, due to reduced spending on health support compared to a year before.

Construction grew at 1.6% in Q4 2022, slightly faster than the 0.6% growth registered in Q3 2022.

Manufacturing grew 5.6% and steel related manufacturing industry also expanded. Base metals industry grew -+15.1%, followed by machinery & equipment (+7.0%) and transportation equipment (+11.0%). The mining sector expanded 6.5%, led by expansion in non-oil & gas sectors. Coal & lignite mining expanded 14.8% while metal ore mining expanded 16.2% in Q4 2022.

Malaysia’s economy grew 7.0% in Q4 2022, mainly due to increasing consumption in line with more economic activities in line that came with the further easing of containment measures.

Private consumption which formed 56.7% of GDP was up by 7.4% in Q4 2022. Government consumption was also up by 2.4%.

Gross fixed capital formation also grew 8.8% with private investment growing 10.3% while public investment grew 6.0%. Note that private investment accounts for 67.1% of total investments.

Both exports and imports continued to grow at 9.6% and 8.1% respectively, with in line with more manufacturing activities.

Construction activities grew 10.1% in Q4 2022. Expansion was supported by growth in civil engineering (+17.9%), non-residential building (+10.7%), specialised construction (+8.1%), and residential construction (+2.7%) activities. Civil engineering construction activities expanded much faster than in Q3 2022 (+10.1%).

Manufacturing was up by 3.9% in Q4 2022 slower than the 13.2% growth in Q3 2022 year on year. Steel sector related manufacturing are all under expansion. The motor vehicle and transport equipment cluster grew 5.0%, followed by the electrical equipment (+7.5%), fabricated metals (+3.3%), machinery and equipment (+1.6%) and base metal (+0.1%) clusters. Note that the motor vehicle and transport equipment cluster grew much slower as tax incentives expire and buyers continue to wait for delivery of motor vehicles.

The mining sector expanded by 6.8% across all mining and quarrying sectors.

The Philippine economy grew 7.2% in Q4 2022, slightly slower that the 7.6% growth in Q3 2022. Growth was mainly driven by:

On the industry side, all economic sectors expanded, except agriculture, forestry and fishing. The construction sector grew by 6.3% in Q4 2022, slower than 12.6% growth a quarter before.

The manufacturing sector grew by 4.2% in Q4 2022, faster than the quarter before. The transport equipment cluster expanded +10.9%, followed by machinery and equipment (+18.2%) and fabricated metal products (+14.4%). The manufacture of electrical equipment declined 9.3% followed by a contraction in the basic metals cluster by 8.1% in Q4.

The mining sector grew 1.7% in Q4 2022, much slower than the 10.0% expansion the quarter before.

The Singapore economy grew by 2.1% in Q4 2022, slightly slower that the 4.4% growth in Q3 2022. All industry sectors expanded during the quarter, except for the manufacturing sector.

The construction sector grew by 10.0% in Q4 2022, faster than the 8.1% growth in the previous quarter.

Growth came on the back of an expansion in both private and public sector construction works.

Construction demand (contract awarded) increased by 8.1% year-on-year in Q4 2022, following the previous 36.8% decline. This was mainly due to:

Certified progress payments grew by 17.7%, following the 16.8% increase in the previous quarter. Higher certified progress payments came from:

The manufacturing sector contracted 2.6% in Q4 2022, compared to the 1.1% growth in Q3 2022. All clusters declined except the transport engineering and precision engineering clusters.

Output in the transport engineering cluster rose +11.5%, supported by expansions in the aerospace (+24.4%) segment, followed by a 4.1% growth in the marine & offshore engineering segment (M&OE). The M&OE segment expanded due to an increase in production of oilfield and gasfield equipment.

Thailand’s GDP expanded by 1.4% year on year in Q4 2022, slowing down from a 4.6% growth the quarter before.

Private consumption grew 5.7% in Q4 2022, decelerating from a 9.1% increase in Q3 2022, with higher household spending mainly on restaurants and hotels (+92.8%), recreation and culture (+11.2%), food and non-alcoholic beverages (+4.3%), alcoholic beverages and narcotics (+3.7%) clothing and footwear (+3.4%), education (+3.2%), in line with the easing of COVID19 restrictions and the release of pent-up demand. Purchase of vehicles declined 2.6%.

Government consumption contracted 8.0%, continuing a contraction of 1.5% the quarter before, as health support continue to ease with the opening of economy.

Fixed investments continued to expand by 3.9%, after a 5.5% growth the quarter before, led by private construction investments (+1.9%), public construction investment (+3.3%) and machinery and equipment (+4.4%).

Export contracted 0.7% in Q4 2022, reversing 6 quarters of expansion. Imports also contracted 4.6%, reversing 7 quarters of expansion.

On the industry side, the construction sector expanded 2.6%, reversing 5 quarters of contraction mainly due to the expansion in public construction, especially in other construction from both general government and state enterprises, which accelerated from a decline in the previous quarter.

As for private construction, there was a slowdown in the growth rates of residential buildings, commercial buildings and industrial projects. In contrast, growth rate of other construction of private sector improved, partly due to a low-base effect from the end of construction of MRT Pink and Yellow line and lack of project entering the construction phase in Q4 2021. In addition, the expansion of construction was also induced by a reduction in prices of essential construction materials, such as concrete products, cement, iron, and steel products.

The manufacturing sector also contracted 4.9%, reversing the expansion of 6.0% in Q3 2022, mainly due to higher cost of production, a slowdown in domestic demand and external demand in line with major trading partners’ economic situation.

The mining and quarrying sector declined further at 6.9% year on year in Q4 2022, following a contraction of 13.3% a quarter ago. This latest contraction marks 6 years of negative growth for this sector.

Vietnam’s GDP rose by 5.9% year on year in Q4 2022, decelerating from 13.7% growth in Q3 2022, fifth consecutive quarter of growth after a contraction in Q3 2021 due to the Delta variant.

Construction activities rose by 6.7% year on year in Q4 2022, easing from 17.5% growth the quarter before. Construction sector grew 5 quarters in a row, after a contraction of 10.1% in Q3 2021 when lockdowns of major economic zones hit the economy.

The manufacturing sector expanded by 3.0% year on year in Q4 2022 following a growth of 11.6% growth the previous quarter. Manufacturing activities related to the steel and steel consuming sectors performance is shown below (vs Q3 2022):

The mining sector declined 5.1% in Q4 2022, led mainly by contraction in the mining of coal and lignite (-7.1%), followed by extraction of crude petroleum and natural gas (-6.6%). Mining of metal ores subsector expanded 44%, reversing a contraction of 16.1% the quarter before.

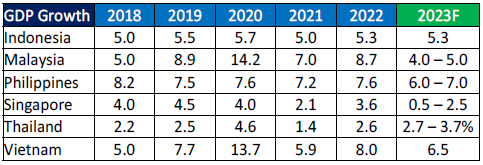

ASEAN GDP 2018-2021 and Forecast for 2022

ASEAN-6 governments continue to be optimistic about achieving economic growth in 2023. While growth in China is set up to lift regional economies, with the easing of pandemic rules, outlook for Western economies (such as the US and EU), remains weak because of tight financial conditions. Weakening demand, together with escalating geopolitical tensions, high interest rates will continue to heavily on ASEAN countries.

Stay Healthy. Stay Safe.

See You at SEAISI Events.

Source:SEAISI