Posted on 21 Mar 2023

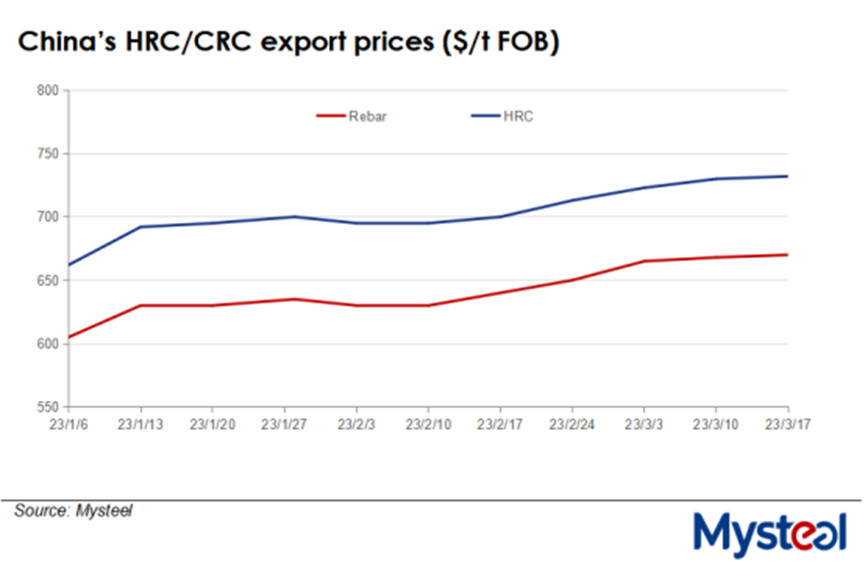

In sync with rising raw materials prices and the climb in hot rolled coil prices globally, prices of Chinese HRC for export maintained their upward momentum last week, with the export price of SS400 4.75mm HRC under Mysteel's assessment inching upbya tiny $2/tonneon weekas of March 17 to reach $670/t FOB from North China's Tianjin port.

At the same time, the export price of SPCC 1.0mm cold-rolled coils also gained by a small $2/t on week to settle at $732/t FOB, also from Tianjin port.

Chinese steel mills were still coping with high production costs last week, which they tried to offset with by raising export prices for steel. For example, on March 17, Mysteel SEADEX 62% Australian Fines index for iron ore was assessed at $132.1/dmt CFR Qingdao, or up $2.15/dmt on week, while Mysteel PORTDEX 62% Australian Fines in Qingdao was also higher by a tiny Yuan 4/wmt ($0.6/wmt) on week at Yuan 937/wmt FOT and including 13% VAT.

In addition, global steelmakers and hot coil traders also lifted their offering prices, which gave the export prices of China-origin hot coils some support, a Beijing market source commented.

For example, in China's home market, Baoshan Iron & Steel Co, the listed-arm of the world's largest steelmaker China Baowu Steel Group, decided to add Yuan 200/tonne ($28.9/t) to its list prices of carbon steel HRC for domestic April sales, while overseas, Vietnam's major steelmaker Formosa Ha Tinh Steel had increased its domestic HRC price for May shipments by $33/t on month to the equivalent of $732/t CIF Ho Chi Minh City, as reported.

Transactions involving Chinese hot coils for export were rather mediocre last week, market sources noted, as many leading Chinese steelmakers had little incentive to table export offers, given that overseas steel demand was feeble overall and most buyers in Southeast Asia were bidding at prices below $670/t CFR.

Source:Mysteel Global