Posted on 10 Mar 2023

Arrival of Carbon Tax

Over the last couple of years, I have been highlighting the arrival of Carbon Tax in ASEAN.

It started in Singapore in 2019 at SGD 5/tCO2e. The carbon tax will rise to SGD 25/tCO2e in 2024 and to SGD 45/tCO2e in 2026. It is expected to reach SGD 50 – 80 /tCO2e by 2030.

Indonesia has postponed its carbon tax (~USD2/tCO2e) since April 2022, due to the current economic challenges. Other ASEAN countries are set to introduce carbon taxes.

What Can the Steel Industry Do?

With the arrival of carbon tax, it means the cost of sales have risen and that makes the steel producer less competitive in the market, especially against imports that are not taxed for their carbon emissions.

Among the options for the steel producer are:

Whatever options are available, steel producers’ efforts do not level the playing field against non-carbon tax adjusted imports. The only way to level this strategic disadvantage is to work with governments on the introduction of carbon border taxes on imports.

SEAISI has brought experts into our events to share their expertise about technologies and plans on process improvement, cost reduction and decarbonisation, and we will continue to do that. However, for this article, the focus will be on Carbon Credits.

What are Carbon Credits and Carbon Offsets?

1 carbon credit/offset refers to 1 ton of carbon dioxide equivalent (CO2e) emissions that have been either stored or avoided.

The difference between Carbon Credits and Carbon Offsets is that:

Note that the two terms are sometimes used interchangeably. Still, the distinction between regulatory compliance credits and voluntary offsets should be noted.

What is Carbon Dioxide equivalent (CO2e)?

Carbon dioxide (CO2) is a primary greenhouse gas (GHG) emitted through human activities. However, there are many other GHGs that cause global warming by trapping the heat in the earth’s atmosphere. To take the total impact of GHG into account, carbon dioxide equivalent (CO2e) is used.

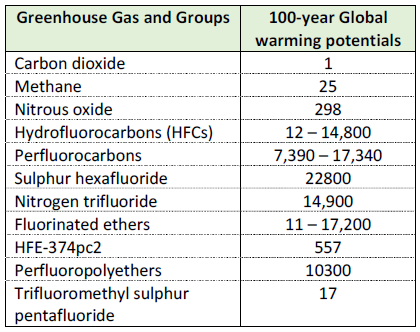

CO2e is a metric used to compare the emissions of different GHG based on their global warming potential (GWP). The GWP of a gas is a measure of how much energy the gas absorbs over a certain period of time, and is expressed as a multiple of the amount of energy absorbed by a similar mass of CO2. CO2e is calculated by multiplying the mass of a greenhouse gas by its GWP, and then adding the results for all the gases in question. This allows for a convenient way to compare the total warming impact of different gases, even if they have different chemical properties and atmospheric lifetimes. The Intergovernmental Panel on Climate Change (IPCC) has released the GWP values for a long list of GHG in their 4th Assessment Report of the IPCC in 2007. Carbon dioxide is taken as the gas of reference and given a 100-year GWP of 1. Therefore, using the table below, methane has a GWP of 25and a 1,000-ton methane emission will be equivalent to 25,000 tons of CO2.

Table: Greenhouse Gas and Groups and their GWP

What are High Quality Carbon Credits?

Many companies are seeking out high quality carbon credits to offset their emissions and to lower their carbon tax costs. The steel industry is one such sector that would need high carbon credits.

High quality carbon credits are those that have been verified and certified to meet a set of rigorous and transparent standards and guidelines, which are intended to ensure that the carbon credits represent real, measurable, and permanent emissions reductions.

The assessment criteria for high quality carbon credits can vary depending on the certification standard or methodology used, with some common criteria being:

High-quality carbon offset projects should also be transparent and follow the best practices, and they should be able to demonstrate the required benefits.

What are the Standards for High Quality Carbon Credits?

Several standards are considered as high-quality standards for carbon offsetting, including:

Note however, the specific criteria, methodologies and rigor can differ among them. Companies and organizations can choose the standard that best aligns with their specific needs and requirements.

Happy Lunar New Year (22-23 Jan 2023)

On behalf of SEAISI, to our Members, Stakeholders, Special Guests, Speakers, Delegates, Sponsors, Advertisers, Exhibitors who celebrate Lunar New Year, I would like to wish all of you a Happy, Healthy and Prosperous Lunar New Year. For those who are having holidays during this period, I would like to wish you a Happy and Safe Holiday season.

Stay Healthy. Stay Safe.

See You at SEAISI Events.

Source:SEAISI