Posted on 17 Feb 2023

ASEAN GDP Q3 2022

The ASEAN Q3 2022 macroeconomic results are out. Despite all the challenges of the year due to the Ukraine war, volatile commodity prices, high interest rates and falling local currencies, ASEAN-6 economies all posted an expansion in Q3 2022 year on year.

Singapore is the only ASEAN-6 country that registered 7 consecutive quarters of economic growth. Indonesia’s and Philippines’ GDP expanded 6 quarters in a row. Malaysia, Thailand and Vietnam, after their restrictions during Q3 2021 only registered 4 consecutive quarters of growth.

Indonesia’s economy grew by 5.7% in Q3 2022 year-on-year, a slight improvement over Q2 2023.

Growth in Q3 2022 was supported by

However, Government consumption declined by 2.9%, due to reduced spending on COVID measures compared to a year before.

Construction grew marginally at 0.6% in Q3 2022, slightly slower than the 0.1% in Q2. While growth is slow, the Construction sector was a major contributor to the overall GDP growth in Q3 2022 (9.5%).

Manufacturing grew 4.8% and steel related manufacturing industry also expanded. Base metals industry grew +20.2%, followed by machinery & equipment (+17.7%) and transporttation equipment (+10.3%).

The mining sector expanded 3.2%,led by expansion in non-oil & gas sectors. Coal & lignite mining expanded 9.4% while metal ore mining expanded 9.0% in Q3 2022.

Malaysia’s economy grew +14.2% in Q3 2022, mainly due to increasing consumption in line with more economic activities as COVID measures were eased.

Private consumption which formed 59.4% of GDP was up by 15.1% in Q3 2022. Government consumption was also up by 4.5%.

Gross fixed capital formation also grew 13.1% with private investment growing 13.2% while public investment grew 13.1%. Note that private investment accounts for 80.6% of total investments.

Both exports and imports continued to grow at 23.9% and 24.4% respectively, with in line with more manufacturing activities.

Construction activities grew 15.3% in Q3 2022. Expansion is supported by growth in non-residential building (30.5%), specialised construction (13.7%), civil engineering (10.1%) and residential construction (9.8%) activities. Civil engineering construction activities turned around in Q3 2022 after 4 quarters of contraction in a row.

Manufacturing was up by 13.2% in Q3 2022 year on year, with steel sector related manufacturing all under expansion. The motor vehicle and transport equipment cluster grew 41.5%, followed by the electrical equipment (13.5%), fabricated metals (12.3%), machinery and equipment (10.8%) and base metal (9.1%) clusters. However, fabricated metals, electrical equipment and motor vehicle and transport equipment clusters performance declined from the quarter with the reduction in private investments.

The mining sector expanded by 9.2% across all mining and quarrying sectors.

The Philippine economy grew 7.6% in Q3 2022, less than expected due to inflation. Growth was mainly driven by:

On the industry side, all economic sectors expanded. The construction sector grew by 12.2% in Q3 2022 (6 quarters of double-digit expansion in a row).

The manufacturing sector grew much slower by 3.6% in Q3 2022, affected by inflationary pressures.

Machinery and equipment expanded +25.5%, followed by fabricated metal products (+7.0%) and electrical equipment (+3.1%). The manufacture of basic metals cluster contracted 15.1% in Q3 2022 after a 10.4% contraction a quarter before.

The mining sector grew 9.1%, reversing a contraction of 6.6% the quarter before.

The Singapore economy grew by 4.1% in Q3 2022, slightly slower that the 4.5% growth in Q2 2022. All industry sectors expanded during the quarter, except for the accommodation sector.

The construction sector grew by 7.8% in Q3 2022, up from the 4.8% in the previous quarter. Growth came on the back of an expansion in both private and public sector construction output.

Certified progress payments grew by 16.8%, following the 10.6% increase in the previous quarter. Higher certified progress payments came from both private (+11.9%) and public (+22.1%) sector construction works. These were largely driven by higher outputs in the private residential buildings (+29.7%), commercial building (32.7%), public residential building (+65.3%) and civil engineering (+13.8%) works.

Construction demand (contracts awarded) fell by 20.3% year-on-year in Q3 2022, following the previous 36.8% decline. The fall in contracts awarded during the quarter was due to:

The manufacturing sector slowed down to a 0.8% growth in Q3 2022, compared to 5.6% growth in Q2. Growth was supported by output expansions in the transport engineering, general manufacturing and precision engineering clusters.

Output in the transport engineering cluster rose 3.05%, supported by expansions in the marine & offshore engineering (M&OE at +50.4%) and aerospace (+31.3%). The M&OE segment expanded due to more activities in shipyards and production of oil and gas equipment.

On the expenditure side, private consumption rose 11.4% moderating from 13.8% the previous quarter. Government consumption fell by 3.8%, continuing the previous 2 quarter of contraction. Gross capital fixed formation was up slightly by 3.5%. Exports also rose 9.1% while imports grew 10.7% in Q3 2022.

Thailand’s GDP expanded by 4.5% year on year in Q3 2022, improving from a 2.5% growth the quarter before. Q3 2022 growth was the fastest since Q2 2021.

Private consumption grew 9.0% in Q3 2022, improving from 7.1% in Q2 with higher household spending mainly on vehicles (+33.9%), transport services (15.8%), recreation and culture (+7.8%), restaurants and hotels (+88.4%), in line with the easing of COVID19 restrictions and the release of pent-up demand.

Government consumption contracted 0.6%, reversing 9 quarters of expansion, dragged down by lower public purchases from enterprises and abroad in line with lower healthcare expenditure for COVID measures. Q2 2022 growth was 2.8%.

Fixed investments rebounded 5.2%, reversing a 1.0% contraction, led by private investments (+11.0%), offsetting the contraction in public investments (-7.3%).

Private investments expanded by 11.0%, with more investment in machinery & equipment (+13.9%), construction (+2.0%). Public investment declined 7.3% mainly due to contraction in investment in construction (-5.9%) and machinery and equipment (-11.6%).

Export grew 9.5% year on year in Q3 2022, up 8.5% from Q2 2022. Import also grew 8.2%, slightly slower than 9.5% the quarter before.

On the industry side, the construction sector declined by 2.8% in Q3 2022, extending the decline of 4.5% in the previous quarter and marking 5 quarters of contraction.

The manufacturing sector turned around with an expansion of 6.3% in Q3 2022, in line with an 8.1% increase in the Manufacturing Production Index (MPI).

MPI with growth included motor vehicles (36.1%), refined petroleum products (17.3%) and sugar (46.1%). Those that contracted included computer and peripheral equipment (-32.4%), basic iron and steel (-12.7%) and plastics and synthetic rubber in primary forms (-10.9%).

The mining and quarrying sector declined further at 14.8% year on year in Q3 2022, following a contraction of 22.4% a quarter ago. This latest contraction marks 5 years of negative growth for this sector.

Vietnam’s GDP rose by 13.7% year on year in Q3 2022, accelerating from 7.7% in Q2 2022, fourth consecutive quarter of growth after a contraction in Q3 2021 due to the Delta variant.

Construction activities rose by 16.6% year on year in Q3 2022, up from 4.9% the quarter before. Construction sector grew 4 quarters in a row, after a contraction of 10.1% in Q3 2021 when lockdowns of major economic zones hit the economy.

The manufacturing sector expanded by 13.3% year on year in Q3 2022 following a growth of 11.1% the previous quarter. Manufacturing activities related to the steel and steel consuming sectors performance is shown below (vs Q2 2022):

The mining sector expanded 6.6% in Q32 2022, led mainly by expansions in the mining of metal ores (+5.1%) and mining of coal and lignite (+7.1%).

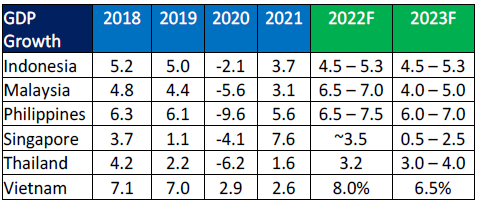

ASEAN GDP 2018-2021 and Forecast for 2022

ASEAN-6 governments continue to be optimistic about achieving economic growth in 2022 despite challenges for the year. Malaysia and Indonesia have revised their forecast upwards. The other countries are expecting to achieve their previous forecast for 2022.

All ASEAN-6 countries are also forecasting further economic expansion in 2023 as shown in the table below.

However, challenges are ahead in 2023 in the form of global slowdown from tightening of monetary policies globally, continuing disruption to supply chains due to the Ukraine war, high inflation, volatile commodity prices.

Season Greetings

On behalf of SEAISI, I would like to wish all our Members, Stakeholders, Special Guests, Speakers, Delegates, Sponsors, Advertisers, Exhibitors a Merry Christmas and a Happy New Year.

Stay Healthy. Stay Safe.

See You at SEAISI Events.

Source:SEAISI