Posted on 21 Nov 2022

Analysts have reiterated their “positive” recommendation on the construction sector in view of what they call, “manageable” cost headwinds and the potential roll-out of infrastructure projects in Malaysia.

MIDF Research analysts said such optimism is also supported by positive developments within the industry, driven by the upcoming mass rapid transit 3 (MRT3) tender awards by the end of 2022.

“Prospects are also looking favourable in Sarawak with positive job flows expected, especially due to its RM100bil capital injection by 2030.

“We are also looking forward to the potential revival of the axed KL-Singapore High Speed Rail, which may be a key focus area of the new government after the general election,” MIDF Research said in a report.

“With all the ongoing and upcoming developments, we are staying positive on the construction sector, with a preference for companies with robust balance sheets and strong overseas presence, namely Gamuda Bhd, IJM Corp Bhd and Sunway Construction Bhd, all of which are front-runners for the MRT3 main contracts.

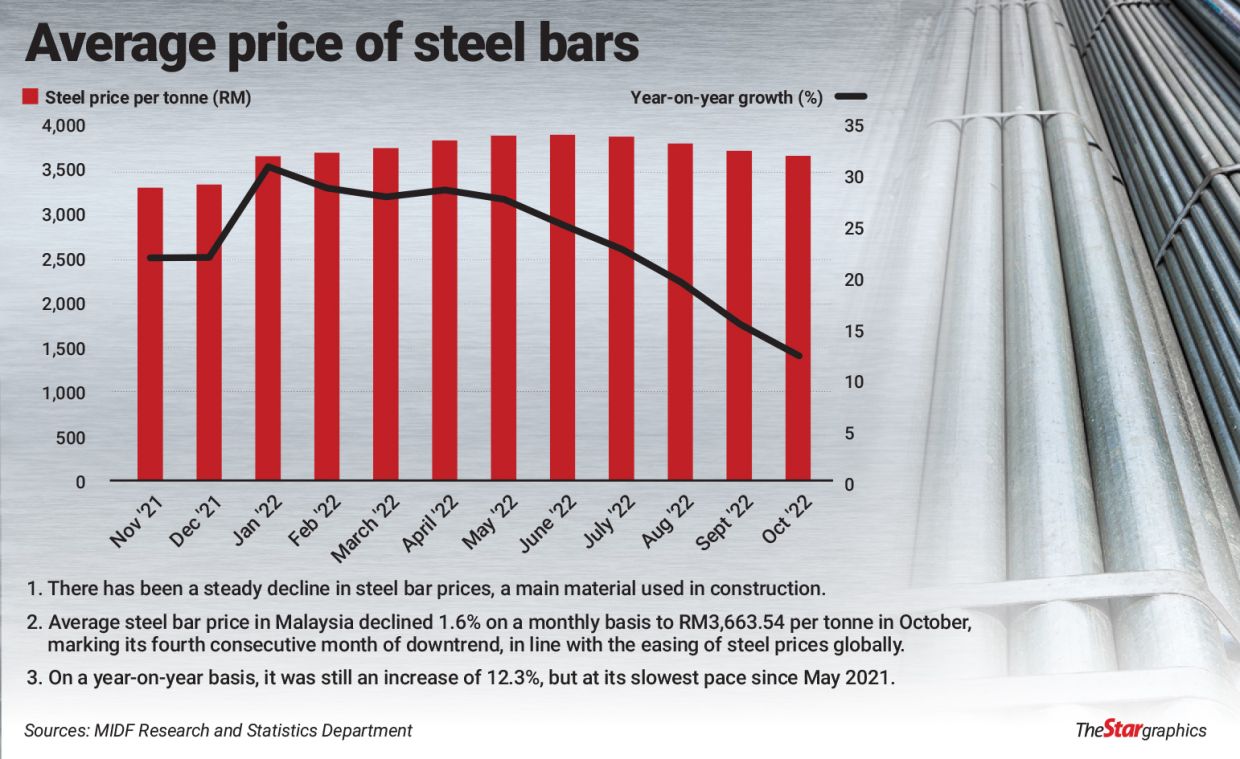

In its report, MIDF Research also noted that there has been a steady decline for steel bar prices, a main material used in construction.

“Average steel bar prices in Malaysia declined 1.6% on a monthly basis to RM3,663.54 per tonne in October, marking its fourth consecutive month of downtrend, in line with the easing of steel prices globally.

“On a year-on-year basis, it was still an increase of 12.3%, but at its slowest pace since May 2021.

“Cement prices also recorded a decline, by 0.5% on a monthly basis to RM20.81 per 50kg bag.”

MIDF Research also said based on the Statistics Department data released recently, the prices of five types of mild steel bars and four types of high tensile deformed bars it tracked were generally lower across the board.

“Average steel bar prices in the Peninsular retreated 3.3% month-on-month (m-o-m) to RM3,212.14 per tonne.

The central region saw the highest decline of 4% m-o-m to RM3,487.69 per tonne. In East Malaysia, average prices were 0.82% m-o-m lower to RM3,899.24 per tonne, with the highest decline recorded in Miri at 1.8% m-o-m to RM3,793.97 per tonne.”

Recall that average steel bar prices in the country peaked at RM3,901.81 per tonne in June this year after 19 consecutive months of increase, the research house added.

It also noted in its report that cement prices averaged RM20.81 per 50kg bag in October.

Peninsular prices recorded a decline of 1.3% m-o-m to RM18.06. The northern region saw the highest reduction of 2.1% m-o-m to RM16.81.

In Sabah and Sarawak, average cement prices declined only by 0.18% to RM22.19 per 50kg bag. Prices mostly remained unchanged in the regions tracked except for a 1.1% decline in Sandakan to RM22.75,” said MIDF Research.

“We reiterate our view as per our previous reports that we are not overly concerned about building materials price headwinds being a huge risk to the construction sector.

“While prices still remain elevated, we are comforted by the declining trend that has been observed over the past few months.

“We expect margins to continue to improve in the fourth quarter of this year onwards though there may be a dampener due to higher labour cost,” it said.

This is due to a shortage of foreign workers but we expect this situation to improve moving forward as construction is among the sectors that are allowed to hire from all 15 permitted source countries.”

Source:The Star