Posted on 25 Jul 2022

May has arrived and the war continues to rage on, relentlessly. Lives continue to be lost. Markets are in turmoil with commodity price volatility. May is also the month that ASEAN-6 countries (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) release their Q1 2022 macroeconomics results.

ASEAN GDP Q4 2021

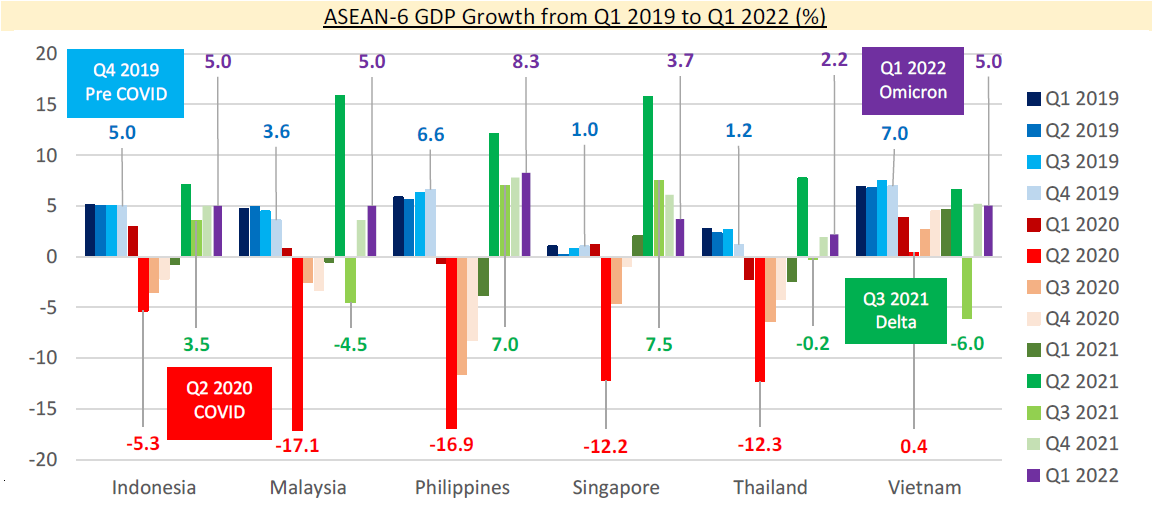

As expected, the Q1 2022 ASEAN macroeconomics results show a continuing economic expansion from Q1 2021. Charts on Q1 2022 results are after this article.

Malaysia, Thailand and Vietnam imposed restrictions during Q3 of 2021 and their economies were affected during that quarter. As such, they only registered 2 consecutive quarters of growth. Indonesia and Philippines registered 4 consecutive quarters of economic, while it was 5 quarters for Singapore.

Indonesia’s economy grew by 5.0% in Q1 2022 year-on-year, mainly due to the relaxation of restrictions and the spike in commodity prices.

Growth in Q1 2022 was supported by

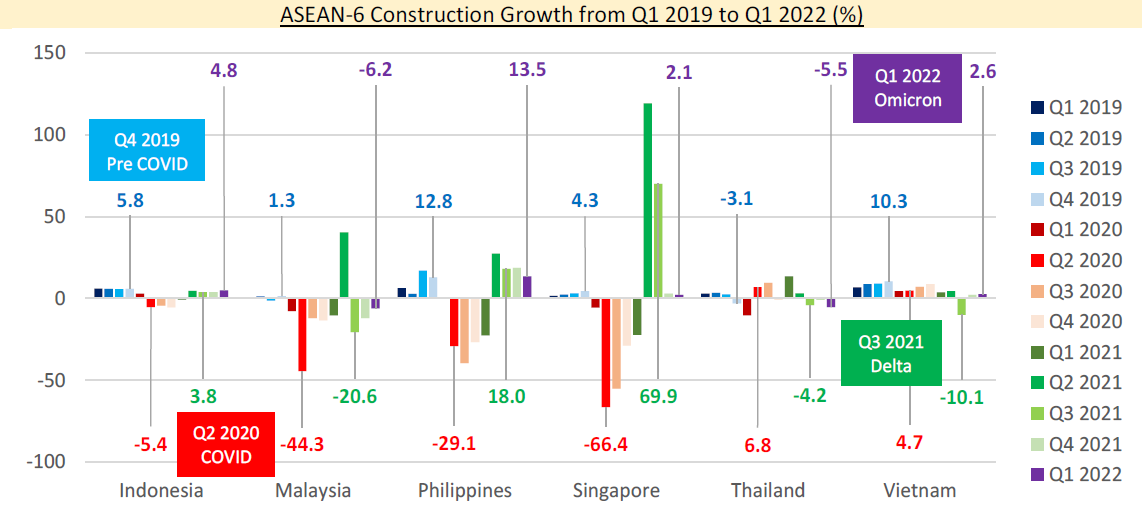

Construction sector grew 4.8% in Q1 2022 as activities resumed.

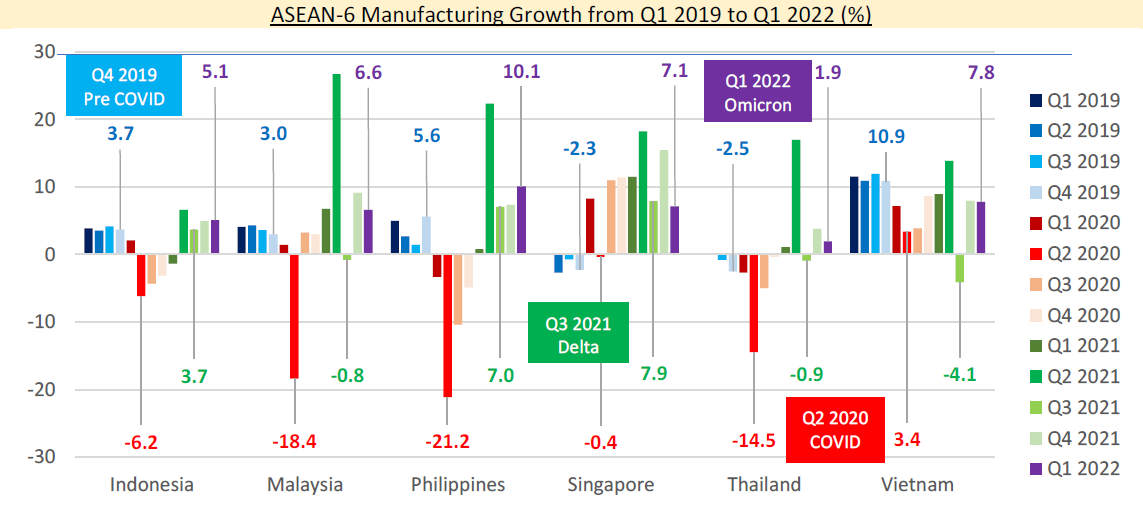

Similarly, manufacturing grew 4.8% and steel related manufacturing industry also expanded (Base metals industry +7.9%, metal goods, computers, electrical & electronics +6.8%, machinery & equipment +9.9%, transportation equipment +14.2%)

The mining sector declined 2.81% led by decline in oil & gas, coal & lignite and other mining & quarrying activities. Only the mining of metal ore continued to expand at 5.4% in Q1 2022.

Malaysia’s economy grew +5.0% in Q1 2021, mainly due to continuing economic activities in line with the easing of containment measures.

Construction activities declined 6.2%, in Q1 2022, led by declines in residential (-15.3%) and civil engineering (-16.1%) construction activities. Non-residential construction activities remained flat (+0.9%) while specialised construc-tion activities grew at 10.4%.

Manufacturing was up by 6.6% in Q1 2022, with steel sector related manufacturing all under expansion. The electrical equipment cluster grew by 14.5%, followed by basic metal (+6.8%), machinery and equipment (+6.6%), fabricated metal products (+4.2%) and transport equipment (2.1%).

The mining sector declined 1.1% mainly due to a contraction in oil & gas activities.

Private consumption which formed 61% of GDP was up by 5.5% in Q1 2022. Government consumption was also up by 6.7%.

Gross fixed capital formation remained flat with 0.2% growth. Both exports and imports continued to grow with more manufacturing activities.

The Philippine economy grew 8.3% in Q1 2022, mainly driven by household consumption (+10.6%), government consumption (+3.6%), investments (+20.0%). Note that household consumption forms more than 70% of GDP.

Overall exports grew 10.3% with growth in export of goods at 5.9%. Metal related exports all declined: machinery and transport equipment (-30.1%) and metal components (-27.7%).

Imports grew 15.6% with growth in import of goods 12.6% and of services 32%. Import of transport equipment grew 29.6%, industrial machinery & equipment at +1.3% and electrical equipment at +1.0%. On the other hand, import of metalliferous ores and metal scrap declined 58.9%, followed by base metal at

-10.4%, and metal products at -11.2%.

On the industry side, all economic sectors expanded. The construction sector grew by 13.5% in Q1 2022 (4 quarters of expansion in a row).

The manufacturing sector grew by 10.1% in Q1 2022 with 5 quarters of expansion in a row, in line with the resumption of economic activities. The manufacture of basic metals rose 22.4% followed by machinery and equipment (+29.4%), fabricated metal products (+13.7%) and transport equipment (+11.3%). The electrical equipment cluster declined by 3.5%.

On the expenditure side, private consumption grew 3.9% along with the growth of 4.6% of government consumption and of exports of 14.6%. Private investments expanded 2.9% while public investments shrunk 4.6%. For private investment, investment in machinery and equipment grew by 5.4% while the investment in construction dropped by 8.0%.

Export of goods grew 14.6% in Q1 2022, with steel consuming sectors with mixed performance. Growth clusters were metal & steel (+21.8%), electrical appliances (7.8%), machinery & equipment (+5.7%). On the other hand, automotive exports fell 5.6% mainly due to the decline in exports of passenger cars (-49.1%), pickup trucks (-28.9%).

Imports of goods grew 16.5% and most steel consuming sectors’ imports also grew: base metal (+19%), machinery & mechanical appliances (+8.9%), aircrafts, ships, floating structures and locomotives (27.1%).

On the industry side, the construction sector declined by 5.5% in Q1 2022, due to the decline in both public and private construction, both affected by the outbreak of the Omicron variant. Public construction declined by 3.9% with Government construction down by 2.1% and State enterprise construction declining by 6.9 %. Private construction declined 6 consecutive quarters to 8.0% mainly caused contraction in the construction of residential buildings and other construction. On the other hand, the construction of non-residential buildings continued to expand for the third consecutive quarter.

Manufacturing sector expanded by 1.9%, dragged down by many reasons. We will only cover the impact of the steel consuming sectors:

The mining and quarrying sector also declined 18.7%.

The mining sector grew 17%, led by coal mining (+48.6%), copper (+60.1%), gold & precious metal ores (+20.1%). Mining for nickel activities declined 33.2%.

The Singapore economy grew by 3.7% in Q1 2022, moderating from 6.1% the previous quarter. All industry sectors expanded during the quarter, with the exception of the accommodation and other goods producing industries that are non-manufacturing, non-construction and non-utilities.

The construction sector grew 2.1%, slightly down from 2.9% growth in Q4 2021. Construction output rose by 11.1% with the growth largely coming from

The manufacturing sector continued to expand at 7.1% led with a 15% growth, followed by transportation and storage (+5.9%).

Thailand’s GDP expanded by 2.2% in Q1 2022 year-on-year, accelerating from a growth of 1.8% the quarter before.

Vietnam’s GDP rose by 5.03% in Q1 2022, second consecutive quarter of growth after a contraction in Q3 2021 due to the Delta variant.

Construction activities rose by 2.6%, continuing the growth from previous quarter after a contraction of 10.1% in Q3 2021 when lockdowns of major economic zones hit the economy.

The manufacturing sector expanded by 7.8% in Q1 2022 following a growth of 8.0% the previous quarter.

All manufacturing activities related to the steel and steel consuming sectors expanded:

The mining sector only expanded 1.0%, led mainly by expansions in the mining of metal ores (+5.0%) and mining of coal and lignite (+3.2%).

What’s Next?

With the bulk of the population having vaccinated with boosters and hospitalisation and death rates remaining low, borders are re-opening and tourists, workers and business travellers are starting to travel once again.

Governments are working on re-starting their stalled economies though reviving public projects to spur growth once again.

However, global forecasts over the last one year whether from World Bank or International Monetary Fund or the Asian Development Bank have been revised downwards over time due to various challenges. The risks to global recover outweigh the gains from efforts to get economies to recover to pre-pandemic levels.

Pent Up Demand and Supply Challenges

As global recovery continues, the rise in demand for goods and services have outstripped supply, leading to a surge in prices, especially energy, commodity and food prices. Inflation was already on the rise, even before the Ukraine war.

Lockdowns in China

China’s strict zero COVID policy has led to the lockdowns in major cities and ports across the country, disrupting supply of goods from the world’s factory to all sectors of

the global economy including the construction materials, manufacturing goods and others. Because of this, global economy continues to be affected by China’s lockdowns, which have yet to end as at end May 2022.

Shortage of Migrant Labour

Countries such as Singapore, Malaysia and Thailand largely rely on migrant labour in the manufacturing, hospitality and retail sectors. Many workers have left for their home countries and have yet to fully return. As these countries open up, migrant labour will continue to trickle in and over time, this will help ease supply crunch.

Ukraine War & Geopolitical Tensions

While global economy recovery is stumbling over supply demand imbalances, the Ukraine war has further exacerbated the situation.

Sanctions on commodities from Russia and fallout impact on Ukraine industrial and agricultural sectors have worsened the supply chain for energy and fuels, cereals, animal feed, cooking oil directly and have also indirectly affected industries that rely on the two countries for rare metals and gases.

Beyond the Ukraine war, geopolitical tensions are continuing in Asia and elsewhere, making the world a much more unsafe place compared to a decade ago.

Rising Interest Rates

Many countries are raising interest rates to combat inflation. But rising interest rates increases business costs and costs of borrowings, which will slow down global economic recovery.

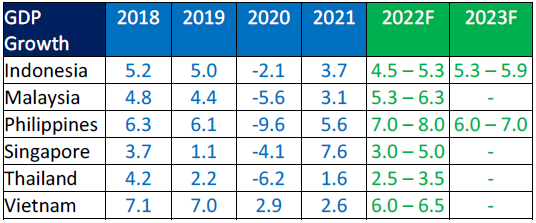

ASEAN GDP 2018-2021 and Forecast for 2022

ASEAN governments have forecasted further expansions in the economies in 2022 amid challenges and risks. Numbers could be revised if risks become reality.

Source:SEAISI