Posted on 14 Jul 2022

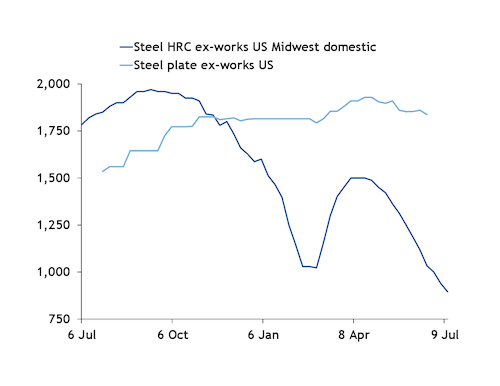

US hot-rolled coil (HRC) ex-works prices have dropped to half the cost of delivered US plate prices over the last two weeks, a first as the two products remain decoupled.

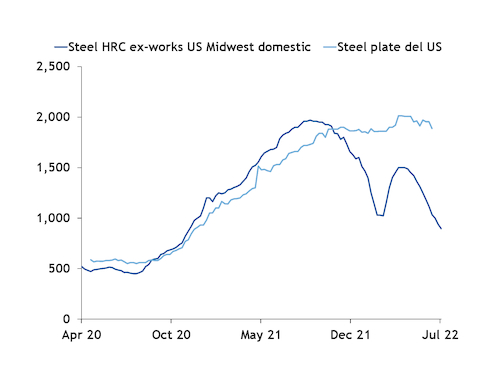

Historically, ex-works HRC and delivered plate prices have tracked within $100/st of each other, with plate generally lagging below HRC. They continued to do so from the beginning of the Covid-19 pandemic through mid-2021, when the Argus delivered plate assessment dropped to $200/st below HRC prices. Since then the spread between the two narrowed before flipping, with plate prices now carrying a $950/st premium, more than double spot HRC prices.

The plate market, which is much smaller than the HRC market with only three main producers, has been held higher by mills that have refused to drop prices by more than small amounts.

Meanwhile, HRC prices have dropped by 44pc since the beginning of the year to $895.50/st, driven by declining demand and chronic oversupply in the market. Buyers have been nervous to purchase steel, with prices broadly dropping since mid-September.

Nucor, one of the largest plate producers which also publishes its prices generally on a monthly basis, lowered their ex-works plate prices by $50/st on 19 May to $1,860/st, and has since kept its prices flat. Freight costs have also remained highly volatile and elevated given increased fuel costs and difficulty securing railcars.

The gaping spread and cheaper imports that are many hundreds of dollars lower than domestic prices have stoked concerns that plate prices could soon be in for a sharp downward correction.

The startup of electric arc furnace (EAF) steelmaker Nucor's new 1.2mn st/yr plate mill in Brandenburg, Kentucky, later this year could be a downward turning point for prices, with the new supply likely to also pressure older plate capacity out of the market.

The plate market has historically been transacted in delivered prices, with the market comparing the delivered plate and ex-works HRC numbers.

US HRC Midwest ex-works vs US plate ex-works $/st

US HRC ex-works vs US plate delivered price $/st

Source:Argus Media