Posted on 14 Jul 2022

The UK government has proposed that the antidumping measures on rebar from China are removed to meet demand from the construction industry.

In its initial findings, the UK's Trade Remedies Authority has proposed July 13 that existing antidumping measures on imports of Steel Concrete Reinforcement Bars, also called High Fatigue Performance rebar, from China should be revoked.

Keeping them "would not be in the economic interests of the UK" due to high demand and the fall in supply from Russia, Belarus and Ukraine in the meantime, according to the TRA.

HFP rebars are mainly used in the construction industry. The industry has been rebounding since the pandemic.

In 2020-21, 27% of total rebar imports came from Belarus, Russia and Ukraine. These imports are likely to drop substantially due to the Russian invasion of Ukraine and the resulting sanctions.

The antidumping measures were imposed back in July 2016 by the European Commission when the UK was still a part of the EU. This is the transitioned measure that was subject to the TRA's transition review.

The EC allowed the EU measure to expire on July 29, 2021, without review.

"We have a duty to weigh up the impact of dumping on UK producers against the broader effects on the UK economy of imposing tariffs," TRA Chief Executive Oliver Griffiths said.

"Our judgement is that the impact on the British economy of higher prices would significantly outweigh the impact on the sole UK producer of rebar of removing tariffs on Chinese imports," he said.

Following the July 13 publication, there will be a 30-day period in which interested parties can comment on the report. The TRA will then consider and produce a Final Recommendation, which will be sent to the Secretary of State for International Trade who will make the final decision on whether to uphold the TRA's recommendation.

UK Steel, the association that represents the country's steel producers, told S&P Global Commodity Insights July 7 that it will present "concrete evidence to Government and the TRA demonstrating that it would be an unforgivable error to uphold such a recommendation that would cause huge damage to UK steel industry."

The association said the UK rebar market is amply supplied both from domestic production as well as from imports, half of which are from the EU, but also a wide array of other origins including Turkey, Algeria and India, "so it is truly bewildering as to how the TRA concluded that UK supply would be constrained but for dumped steel from China."

China is currently exempt from safeguards on rebar as it is considered a developing country whose exports to the UK fall below the 3% threshold, a reason why it was important to keep the antidumping measures in place on this product, according to the association.

The main rebar producer in the UK is Celsa UK and Liberty Steel UK also makes rebar, but both only started producing from the end of 2020, whereas the injury period for this investigation was since 2017. Thus, they were not fully considered for the purposes of this review, UK Steel told S&P Global.

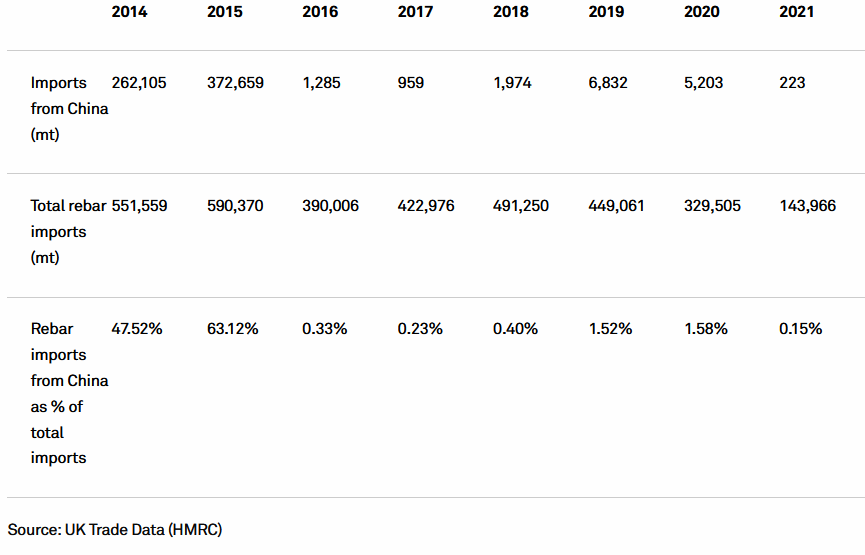

In 2021, the UK imported 35% of its rebar from Portugal, 14% from Spain, 13% Russia, 11% from Algeria and 9% from Turkey, according to UK Steel data. China used to be one of the main rebar exporters before the introduction of the measures in 2016, but after 2016 import volumes from China have clearly dropped.

(all tariff codes listed in the measure taken at an 8 digit level)

China accounts for 78% of global rebar production and just 2% of its spare rebar capacity could meet the entirety of the UK's demand requirements, at a time when Chinese domestic steel demand is weakening, according to UK Steel.

In China, the most actively traded October rebar contract on the Shanghai Futures Exchange was at Yuan 3,910/mt ($581/mt) on July 12, down Yuan 286/mt from July 8, according to the Platts assessment by S&P Global. The price hit a low of Yuan 3,891/mt during the trading session -- the lowest since December 2020.

In the seaborne rebar market, most participants were holding a wait-and-see stance after China rebar futures hit a 19-month low amid high warehouse stock levels in Hong Kong and Singapore.

Platts assessed the 16-32 mm BS4449 Grade 500 rebar price down $10/mt at $639/mt CFR Southeast Asia, while Chinese export 16-20 mm diameter BS500B grade rebar slipped $10/mt to $628/mt FOB China from July 8, according to data from S&P Global.

Source:Platts