Posted on 19 May 2022

On 24 February 2022, Russia invaded Ukraine, sparking an international outrage and condemnation. This was swiftly followed by sanctions led by the Western countries, targeting Russian individuals, businesses, banks, monetary exchanges, bank transfers, exports, and imports. The sanctions also included cutting off major Russian banks from SWIFT and asset freezes on the Russian Central Bank, which holds $630 billion in foreign-exchange reserves as well as reducing energy dependency on Russian gas, oil and coal.

Major multinational companies, including Apple, IKEA, ExxonMobil, and General Motors, have suspended operations in Russia. Many others have disengaged from Russia to comply with sanctions and trade restrictions imposed by home countries or on own their own accord, to avoid the economic and reputational risks associated with maintaining commercial ties with Russia.

ASEAN Response

The response from the 10 ASEAN member states (AMS) varied widely. Singapore condemned the attack and imposed sanctions. Indonesia, Brunei and the Philippines condemned the attack on Ukraine, without naming Russia. Malaysia, Thailand, Vietnam, Laos and Cambodia gave muted responses to the event. Myanmar was the only country to support Russia’s invasion of Ukraine, as Russia was the first superpower to recognise the junta as the legitimate government of Myanmar.

As the situation grew worse in Ukraine, 8 out of 10 AMS joined 141 countries in the UN, to vote for a non-binding resolution which “deplored” Russia’s “aggression” against Ukraine and called the withdrawal of armed forces in

Ukraine. Vietnam and Laos together with 35 countries, abstained.

Impact of the War

The immediate impacts are:

The IMF also added that these high commodity prices (energy and food) “will push up inflation higher and eroding the value of incomes and weighing on demand”.

Neighbouring economies are grappling with disrupted trade, supply chains and remittances as well as an historic surge in refugee flows.

With “reduced business confidence and higher investor uncertainty will weigh on asset prices, tightening financial conditions and potentially spurring capital outflows from emerging markets”.

Impact of the War on ASEAN

Along with the war and economic sanctions imposed on Russia, ASEAN is expected to be hit by some economic fallout, depending on the individual country’s exposure to the Russian and Ukrainian economies.

Direct Impact on Trade in ASEAN

ASEAN’s trade volume with Russia and Ukraine is small. In 2021, total trade (export and imports) between ASEAN and Russia and Ukraine totalled USD 22.1 billion, only 0.7% of total ASEAN global trade of USD 3.2 trillion. As such, the impact of the war on the disruption in trade is minimum to ASEAN.

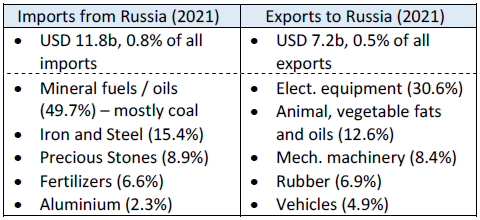

In 2021, ASEAN’s trade with Russia was USD 19 billion, only 0.6% of total trade, with details below:

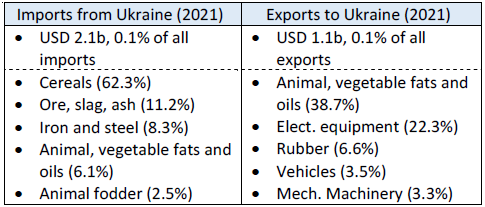

On the other hand, ASEAN’s trade with Ukraine was less, at USD 3.1 billion, only 0.6% of total trade, comprising:

So, in terms of trade, the war does appear to have much direct impact on ASEAN economies.

Direct Impact on the Steel Industry

Russia and Ukraine are major steel exporters of semi-finished products (“semis”) to ASEAN.

Indonesia imported about 27% of its semis from Russia and Ukraine in 2020 and it was 15.8% in the first 11 months of 2021. Billets and slabs were mostly from

Russia while bloom, beam blanks and high carbon semis were from Ukraine.

Thailand imported 13.5% of its semis from the two countries in 2020 and 11.7% in the 11 months of 2021. Most of the semis came from Russia, while in 2021 there some slabs were imported from Ukraine.

For the Philippines, semis from Russia and Ukraine were 42% of total semis import in 2020 and 38% in Jan – Nov 2021. About 80% of these were high carbon semis.

Malaysia, Singapore and Vietnam did not import any semis from the two countries during the same period.

Apart from semis, Vietnam also imported some rails and hot rolled coils from Russia. Some plates were imported into Indonesia from Ukraine. Some quantities of bars and plates were imported into Singapore from Ukraine in 2020. The other steel products are insignificant.

A quick look at the statistics shows that iron ore imports from Russia and Ukraine are not significant (<6%). However, Vietnam imported about 17% of its coking coal from Russia in 2020 and 15% in the 11 months into 2021. In 2020, Indonesia, Thailand, Malaysia and Philippines imported 11.1%, 10.9%, 7.5% and 6.6% of their total bituminous coal, mostly coking coal, from Russia respectively.

Considering the sizeable imports from Russia and Ukraine, ASEAN steel industry players would have to search for alternative supplies of semi-finished products as well as coking coal.

The headlines section of the Journal has more details on steel imports into ASEAN.

Indirect Impact of the War

The indirect impact of the war is a lot more severe as it affected the price of food, energy and commodities because Russia and Ukraine play such a huge role in the trade of these commodities, especially in Europe.

Energy Crisis

The Ukraine War has sparked off an energy crisis worldwide, with prices surging further beyond the increases before 2021. Most ASEAN-6 countries (except Singapore) have price subsidies for energy commodities so that the public can have a low-cost supply of energy. Indonesia, Malaysia, Philippines, Vietnam and Thailand are looking at expanding these, so to help the public cope with rise in energy costs. Raising prices are politically dicey, in view of the upcoming elections, for Malaysia and the Philippines in particular.

Along with higher energy costs, most products will become more expensive due to energy consumption in their production costs and transport costs as well.,

Food Crisis

Rising commodity prices also impact food prices. From the earlier table, ASEAN imports a large quantity of cereals (including wheat) from Russia and Ukraine. Wheat is used to make bread, noodles, biscuits, cakes and many other types of food, typically found in ASEAN. Other grains are used for animal feed, which explains why chicken prices are also on the way up.

Russia and Ukraine’s importance in the supply of sunflower seed and safflower oil is also affecting the price of cooking oil. ASEAN governments are working on supporting the public with various measures such as subsidies (Indonesia, Malaysia, Philippines, Thailand) and reduction in VAT (Vietnam). Indonesia had previously tried to set price and volume controls on cooking oil as well as export controls on palm oil, which did not work.

Continuing Global Supply Chain Disruptions

The war and the resulting sanctions have further worsened the global supply chain structure as countries try to re-adjust their global supplies sources to other than Russia and Ukraine (whether these are energy or commodity supplies).

Disruptions in the supply of semiconductor grade neon and krypton gases are expected to affect the semiconductor industry in ASEAN as well as the automotive industry.

While the war has exacerbated global supply chain disruptions, there are also many other issues that continues to add to the worsening situation.

It also does not help that China is also going through many crises including the tech sector clampdown, education sector crackdown, real estate crisis, energy crisis and major COVID19 lockdowns impacting global supply chains. Being a “global manufacturer”, any disruptions in China will reverberate across the world.

Over the last 6 months or so, the ASEAN side has faced natural disasters. Flooding in Indonesia, Malaysia, Philippines, Vietnam and Thailand have also created local supply chain disruptions.

Border closure has also resulted in the shortage of foreign labour supply for Malaysia, Singapore and Thailand, which affects construction projects, production of goods and other necessary economic activities to maintain smooth supply chains. Borders are being opened now and should alleviate this issue.

Inflation and Interest Rates

With spiralling costs, it is not surprising that countries are facing the challenge of balancing between economic recovery and taming inflation. Inflation affects business competitiveness and viability and may have effect on the labour market, and eventually on private consumption. Uptick in inflation could force central banks to hike interest rates, which could dampen the much-needed return of private consumption and eventual economic recovery, post COVID19. That’s why, perhaps, in ASEAN, only Singapore has raised interest rates, while the other countries are mulling over the situation.

Diversion of Funds from Economic Recovery

After 2 years of being battered by COVID19, with huge fiscal supports, ASEAN countries, like all others, are looking forward to an economic recovery.

However, in the current scenario, continuing support became necessary, further increasing debts and straining reserves. It means, economic recovery will take a backseat for a little while longer, as demand in Europe will be affected by the war and as demand in China continues to weaken.

As the conflict progresses, many countries have to reconsider their security risks and the need to increase their military budgets, again diverting the necessary funds for economic recovery.

Implications to the ASEAN Steel Industry

While commodity prices such as steel, are riding high, many steel producers are profitable or becoming profitable. However, there is the challenge of securing raw materials, for countries depending on steel imports.

Rising prices will continue to put pressure on contractors and developers, especially those who have fixed price project contracts to service. Those who have a fluctuations contract (usually with prices pegged to certain base), may be luckier. But there will be no winner as these costs still need to be funded and the impact could be fewer opportunities in the near future.

Weakening demand and consumption will impact economic recovery, something the world does not need right now.

All in all, the war is bad for everyone. Risks have multiplied. Economic recovery will be postponed.

Get Your Booster. Get Vaccinated

Keep Your Distance. Wear Your Mask.

Stay Healthy. Stay Safe.

Source:SEAISI