Posted on 22 Apr 2022

ASEAN GDP Q4 2021

Indonesia’s economy grew by 5% in Q4 2021 year-on-year, mainly due to lower infection rates leading to the lifting of restrictions and high exports driven by stronger commodity prices. Indonesia is one of the biggest exporters of palm oil, coal and nickel.

The largest steel consuming sector, construction grew by 3.9% in Q4 2022. Manufacturing grew by 4.9%, with expansions in steel related sectors such as basic metal (+11.3%), machinery and equipment (+11.1%) and manufacture of transport equipment (+22.6%). Mining grew by 5.2%, with iron ore mining posting a 24.4% expansion.

On the expenditure side, private consumption grew by 3.5% in Q4 2021 up from 1.1% the previous quarter. Private consumption is about 54% of GDP in Indonesia.

Public consumption, gross capital fixed formation (investments) and exports continued to grow in Q4 2021, while imports remained flat.

Malaysia’s economy grew by 3.6% in Q4 2021, supported by strong external demand.

Construction activities declined by 12.2% across all segments due to COVID19 restrictions, except for specialised construction activities. Note that construction activities have slowed down since 2018 (residential, non-residential, mega projects) and since 2020 (civil engineering) mainly due to the change in government in 2018 and COVID in 2020/2021.

Manufacturing was up by 9.1% in Q4 2021, with steel sector related manufacturing all under expansion. The machinery and equipment segment grew by 17.7% followed by electrical equipment (+14.3%), fabricated metal products (+8.7%) and basic metal (+5.9%). Transport equipment segment (including automobiles) only grew by 1.7%.

Private consumption which formed 58% of GDP was up by 3.7% in Q4 2021. Government consumption was also up by 4.3%. Gross fixed capital formation declined by 3.3%. Both exports and imports continued to grow due to less restrictions.

The Philippines economy grew by 7.7% in Q4 2021; all economic sectors expanded. The construction sector grew by 18.5% in Q4 2021 (3 quarters of expansion in a row).

The manufacturing sector grew by 7.9% in Q4 2021 with 4 quarters of expansion in a row. The manufacture of machinery and equipment grew by 29.4%, followed by basic metals (+28%) and, electrical equipment (+10%). However, manufacture of transport equipment contracted 23.5% followed by fabricated metal products (-2.1%).

Both private and government consumption rose by more than 7% in Q4 2021. Similarly, exports expanded by 8.3% and imports were up by 13.7%. Gross fixed capital formation (GFCF) also grew by 9.5%, of which investment in construction expanded by 15%; this segment forms more than 60% of GFCF.

The Singapore economy grew by 6.1% in Q4 2021, moderating from 7.5% the previous quarter. All sectors expanded during the quarter, with the exception of the accommodation and food & beverage services sectors.

Construction output rose 18.9% year-on-year to $6.9 billion in Q4 2021, backed by expansions in both public (all segments except residential) and private (all segments) sector outputs.

For the major steel consuming sectors, manufacturing led with a 15% growth, followed by transportation and storage (+7.5%) and construction (+2.9%).

Thailand’s GDP expanded by 1.9% in Q4 2021, turning around from a contraction of 0.2% the quarter before.

Construction activities declined by 0.9% in Q4 2021, continuing the Q3 decline of 4.2%, due to a reduction in both private and public construction activities. While private residential and non-residential construction grew, the other construction categories (linked to the completion of the current phase construction of MRT Yellow and Pink lines) dragged the entire private construction down by 0.9%.

Public construction decreased by 0.7%, improving from a 6.3% decline in Q3 2021. The improvement mainly came from the expansion in the government construction, which rose by 6.1% due to a rise in disbursement from government’s construction budget as well as disbursement for economic recovery. Meanwhile, the state enterprise construction activities declined by 14.8%, falling from a rise of 4.3% in Q3 2021 due to no new projects in the pipeline.

In the meantime, manufacturing activities rose by 3.8%, reversing a drop of 0.9% in the previous quarter, with all segments expanding. The raw material segment (which includes basic metals production) grew by 5.5% while the capital and technology segment (which includes machinery and equipment, automobiles) grew by 1.1%.

On the expenditure side, private consumption grew marginally by 0.3%, reversing a contraction of 3.2% in the previous quarter. Government consumption continues to expand by 8.1% during the same period.

Gross fixed capital formation contracted at a marginal 0.2%. Meanwhile both exports and imports expanded by 17.7% and 16.6% in the same quarter.

Vietnam’s GDP rose by 5.2% in Q4 2021, higher than Q4 2021, but still has not reached pre-pandemic levels.

Construction activities rose by 2.1%, reversing a decline of 10.1% in Q3 2021 when lockdowns of major economic zones hit the economy in the third quarter.

The manufacturing sector expanded by 8.0% in Q4 2021. Related to the steel industry, the production of basic metals continues to grow through all 4 quarters of the year. Growth in Q4 2021 was 9.2%, although it was slower than the previous 3 quarters. The fabricated metals segment grew by 9.4%. However, the production of machinery equipment declined by 9.1%, followed by manufacture of electrical equipment (-5.5%) and manufacture of motor vehicles (-4.6%).

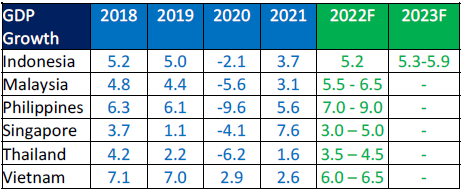

ASEAN GDP 2018-2021 and Forecast for 2022

On the whole Q4 2021 was improvement in economic activities across all ASEAN-6 countries. All the 6 countries’ GDP growth for 2021 are inline with the respective governments’ latest forecasts, except for Singapore, hitting a growth of 7.6%, above its estimate of 4.0 - 6.0%.

Having said all these, challenges remain. Omicron landed in ASEAN around December and the full impact of Omicron is yet to be seen. While it appears that ASEAN economies remain open in spite of Omicron, border re-openings have been cautious.

Furthermore, no one predicted a war in the midst of the pandemic as countries try to recover from the pandemic as well as to control inflation due to rising commodity and energy prices and global supply chain disruptions.

So far, the ASEAN-6 governments have all forecasts further economic growth for 2022. Indonesia has forecasted further into 2023.

We will cover the impact of the Russian Invasion of Ukraine on the ASEAN-6 steel industry in the next edition of the ASEAN Iron and Steel Journal.

Get Vaccinated. Wear A Mask.

Keep Your Distance. Stay Safe.

Source:SEAISI