Posted on 25 Mar 2022

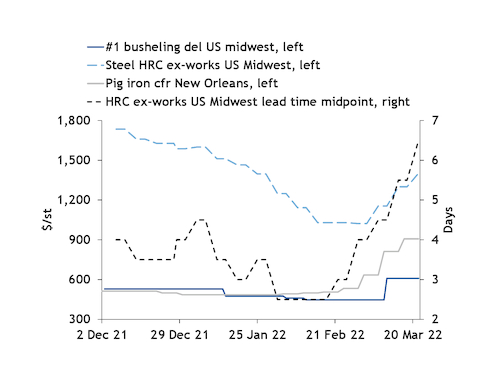

Increasing raw material costs and extending lead times have prompted US hot rolled coil (HRC) prices to surge in the last few weeks.

The Argus US HRC Midwest ex-works assessment has jumped by 37pc since the beginning of March to $1,402/short ton, reversing sharp declines brought on by an oversupplied market.

Since 25 February, scrap-based electric arc furnace (EAF) steelmaker Nucor has increased flat-rolled prices by $275/st. Market participants predict rising raw material costs likely will lead to further finished steel price increases, with some reported HRC price offers as high as $1,500/st.

Steelmaker SSAB added a raw material surcharge on 9 March. The charge is based on a third-party published price for #1 HMS in Chicago.

Pressure has grown in recent weeks on global raw material supply chains as pig iron supply has been cut off from Ukraine and Russia. The supply crunch has led imported pig iron prices cfr New Orleans to jump by 70pc since the beginning of March to $907/st ($1,000/metric tonne) on 17 March. Prices were reported as high as $1,089/st ($1,200/t) for rail deliveries from Canada into the upper Midwest US.

Some US steel buyers warn the raw material shortages are unlikely to resolve in the near term, and potentially during the rest of 2022, especially as steelmaking infrastructure is damaged or destroyed in Ukraine.

In response to the raw material supply tightness, the Argus delivered US Midwest #1 busheling prices rose by $156-170/st ($175-190/gross ton) in the March trade to as high as $643/st in the Cleveland/Youngstown region of Ohio. Some believe scrap prices will rise by at least $89/st ($100/gt) in the April trade, and a potential for a repeat of the March performance.

US HRC and raw material costs

Source:Argus Media